Bitcoin, once a symbol of the inexorable rise of cryptocurrencies, is now faced with an unprecedented challenge. More than 10% below its all-time high, the leading global cryptocurrency is struggling to recover despite a halving event in 2024. This unexpected stagnation is raising multiple concerns among investors and industry experts.

Home » Archives for Luc Jose Adjinacou » Page 49

Luc Jose A.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

Since Tuesday, XRP has experienced an unexpected surge in its trading volume. Within 24 hours, this cryptocurrency recorded a spectacular increase in both the derivatives market and the spot market. Despite the recent turbulence observed in the market, XRP seems to be benefiting from a significant resurgence of interest.

This Tuesday, Nvidia experienced a staggering drop in its market capitalization. The company lost nearly 270 billion dollars. This news, in addition to being an indicator of the current volatility of the market, redefines economic priorities in the era of technological innovation.

This week, Bitcoin exchange-traded funds (ETFs) in the United States recorded massive net outflows of $287.78 million. This is the largest capital loss since the beginning of May. This surprising movement occurs against a backdrop of increased volatility in both traditional and digital financial markets. What are the details of these fund outflows? What underlying factors could explain this phenomenon?

The blockchain network of The Open Network (TON), closely linked to Telegram, has just crossed the historic milestone of over one billion transactions. This achievement comes amid a backdrop troubled by recent disruptions caused by a memecoin airdrop. Indeed, the competition for the adoption of blockchain technologies is intensifying. The performance of TON is raising both interest and concern within the crypto community.

Turkey, a key member of NATO, has just shaken the global geopolitical order with a surprising request to join the BRICS bloc, an economic and political alliance dominated by Russia and China. This initiative represents a decisive step in Ankara's diplomatic strategy, traditionally anchored in strong Western alliances. Turkish President Recep Tayyip Erdoğan appears determined to redefine his country's position on the international chessboard, seeking to establish partnerships beyond its historical alliances with the West. This development comes at a time when geopolitical tensions are high, challenging the balance of power between East and West.

In a constantly evolving ecosystem where projects multiply and technologies compete, few dare to claim they have accomplished one of the greatest technical feats in history. Charles HOSKINSON, the founder of Cardano, made such a statement, placing his project at the pinnacle of global technological achievements. According to him, Cardano is not just another blockchain platform, but a technology comparable to an "unstoppable virus" that inexorably spreads and transforms the crypto industry. This bold assertion comes at a critical moment for Cardano, right after the implementation of the Chang hard fork, and resonates strongly in a crypto community often skeptical of grandiose promises.

On September 1, 2024, Ripple unlocked 1 billion XRP tokens from its escrow accounts once again. This action immediately caught the attention of investors and market observers. Although this operation is routine, it raises questions about Ripple's long-term strategy and its impact on the crypto market. What are the reasons behind this massive release of tokens?

Ethereum has just experienced its worst month in over two years. In August, ETH fell by 22%, wiping out any hope of a quick recovery. This drop comes at a time when many observers were expecting 2024 to be a positive year for the digital asset, particularly due to the anticipation of new regulations and the approval of an ETF. However, the reality is quite different. Factors such as massive fund outflows from Ethereum ETFs, scathing critiques from its co-creator Vitalik Buterin, and a decline in activity on the main network have plunged the market into a downward spiral.

Altcoin investors are in complete disarray. For several months now, secondary crypto markets like BNB, Cardano, and Avalanche have been struggling, with no clear signs of recovery. For some analysts, this is a warning sign of a deeper crisis. From concrete data to future implications, we will explore the reasons why this asset class seems to be wobbling on its foundations.

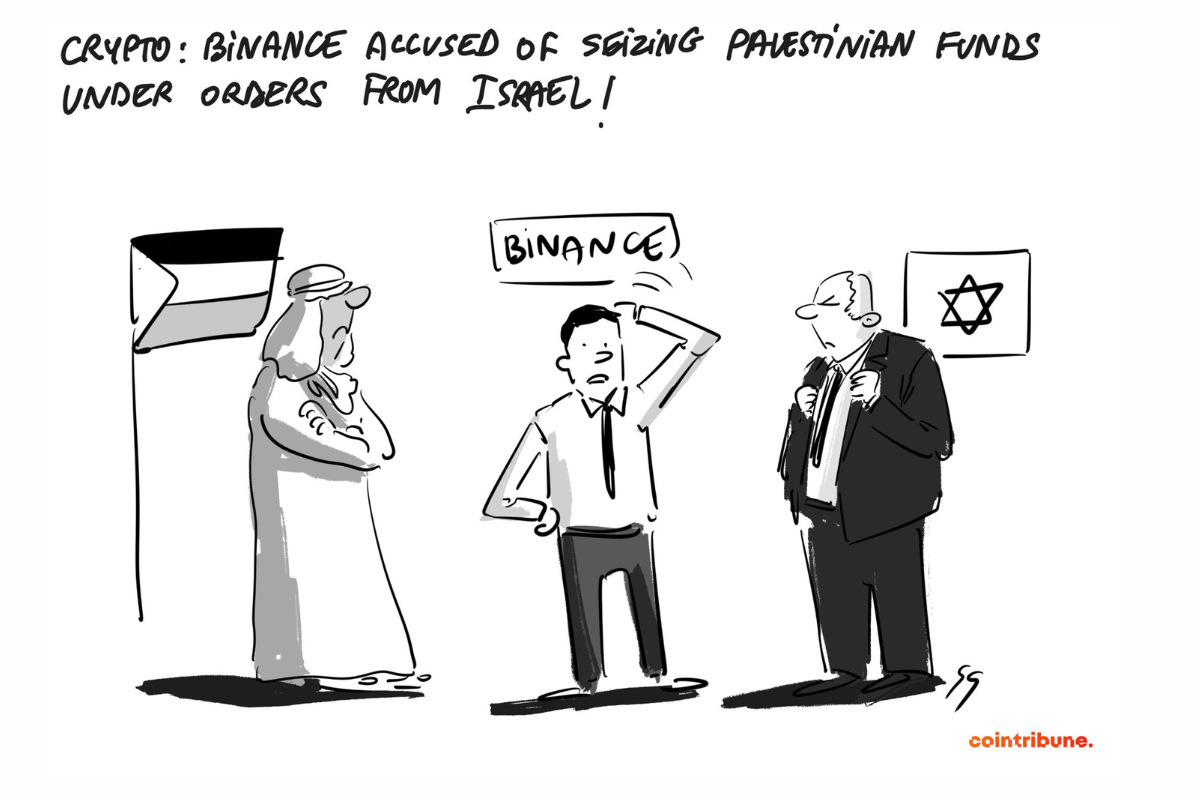

Amid revolutionary announcements, technological developments, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground for regulatory and economic conflicts. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Fluctuations are increasingly scrutinized in the crypto market. Bitcoin, the famous cryptocurrency, after a drop below the 58,000 dollar mark, must now prove its resilience to avoid a potentially dangerous trend break. Will Bitcoin be able to maintain its upward trajectory? Or are we on the brink of a more severe correction?

Financial transparency is becoming increasingly vital for tech companies. Telegram has been at the center of attention for the past few days with the release of its 2023 financial report, which reveals digital assets worth several million dollars. This announcement is surprising at a time when the messaging app, already under pressure for its ties to the crypto world, also has to deal with the fallout from the arrest of its CEO, Pavel DUROV. Why has Telegram decided to diversify its revenues in this way? What are the implications?

The crypto market is increasingly unstable. Despite a slight recovery that gave some confidence to investors, a shadow once again hangs over the future of digital assets. Indeed, Alan SANTANA, one of the most renowned analysts in the field of cryptography, predicts a spectacular collapse of 1 trillion dollars in market capitalization. So what are the factors likely to trigger such a fall?

The question of liquidity in the crypto market remains a major challenge. The recent introduction of exchange-traded funds (ETFs) for Bitcoin (BTC) and Ethereum (ETH) in the United States had raised hopes for improvement. However, according to the latest report from Kaiko, these expectations have only been partially met. Despite an increase in trading volumes on major platforms since November 2022, the reality is that the market remains fragile and vulnerable to sharp fluctuations. This report highlights two areas for reflection: the limited impact of ETFs on the true liquidity of the market, and structural issues.