Amid revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground for regulatory and economic challenges. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Home » Archives for Luc Jose Adjinacou » Page 15

Luc Jose A.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The crypto market has never been shy about ambitious predictions, but a new technical analysis has reignited investor enthusiasm. A rare chart pattern, dubbed the "megaphone pattern," is said to have been crossed by Bitcoin, paving the way for a potential rise to $300,000 by 2025. As the crypto evolves in an environment of growing institutional adoption, and some experts no longer hesitate to compare it to gold, this forecast triggers as much optimism as skepticism.

Regulations surrounding stablecoins are no longer a distant threat for crypto issuers. They are now an unavoidable reality. In this uncertain climate, Tether, the industry leader with a market capitalization exceeding 142 billion dollars, has chosen not to remain a spectator. Rather than directly opposing American lawmakers, the company seeks to influence the regulatory process. A strategic choice that could redefine the future of stablecoins and the entire crypto market in the United States.

"Analyzing crypto market trends often resembles a balancing act between rational anticipation and unpredictable volatility. Since the beginning of the year, Bitcoin has experienced a significant downward trend during weekends, a pattern that has persisted for five consecutive weeks. However, according to Geoffrey Kendrick, the head of crypto research at Standard Chartered, this pattern could be broken as early as this weekend. He anticipates a bullish reversal for Bitcoin, supported by inflows into Bitcoin ETFs and an improvement in the macroeconomic climate. If this analysis proves accurate, the leading global cryptocurrency could regain $100,000, but may aim for $102,500 in the short term."

The Russian economy is wobbling under the weight of its own structural flaws and an increasingly hostile international environment. While the Kremlin attempts to project resilience in the face of Western sanctions and geopolitical tensions, the latest reports from the Bank of Russia and the Ministry of Economy paint a much more troubling reality. With the collapse of oil revenues, a skyrocketing budget deficit, and a private sector on the brink of asphyxiation, Russia faces major economic challenges that could profoundly affect its stability in the medium term.

Is the value of a property still based solely on its location? While the French market is undergoing its most significant correction in decades, the dynamics of the sector seem to be reversing. After a sharp price drop in 2024, the year 2025 is set to be one of profound transformation for the market. From major metropolitan areas to medium-sized cities, from deserted offices to less accessible housing, a shift is taking place, driven by an unprecedented economic and regulatory context. Amid rising interest rates, tighter credit, and new environmental requirements, real estate must rethink its fundamentals.

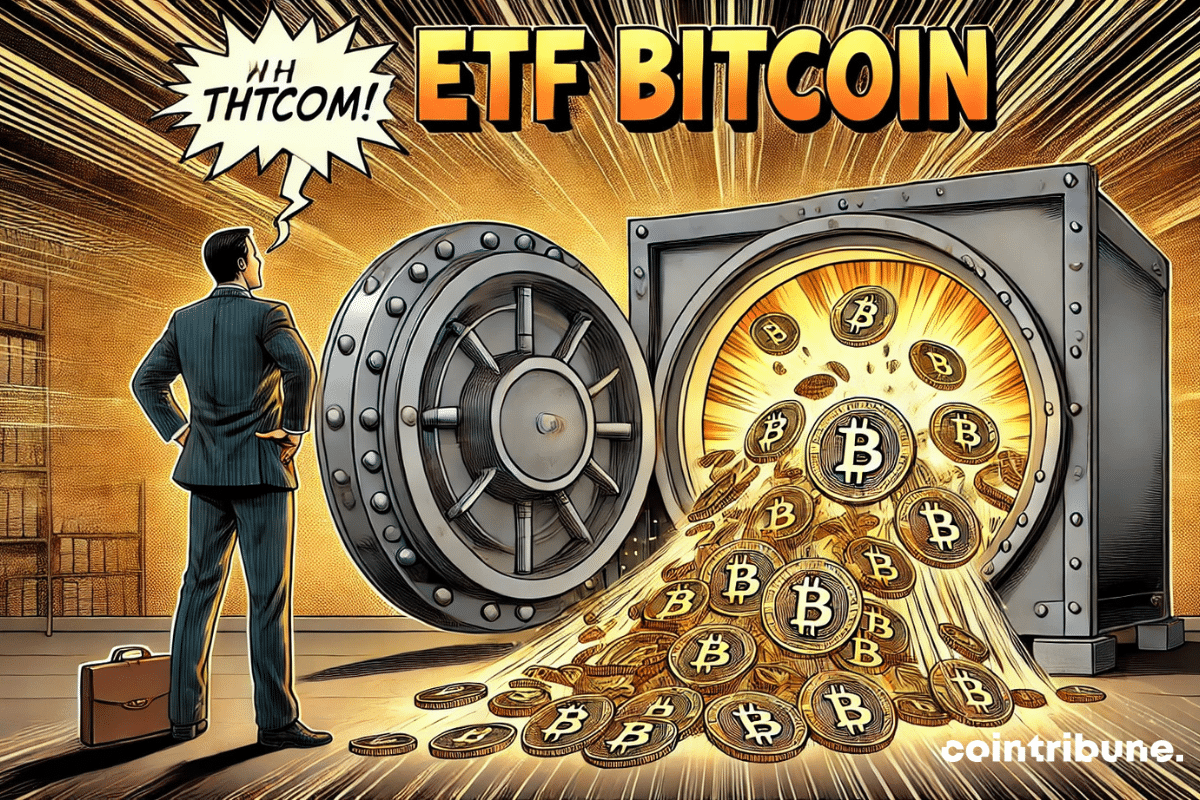

The story of Ripple (XRP) is one of a regulatory battle that has kept the entire crypto industry on edge. After years of tug-of-war with the Securities and Exchange Commission (SEC), an unexpected change has just shaken the market: the U.S. regulator has officially acknowledged the requests for XRP and Dogecoin ETFs filed by Grayscale. Is this just an administrative procedure? Perhaps, but for investors, this signal was enough to propel the price of XRP by 20% in just a few days, with open interest now flirting with 4 billion dollars. Behind this surge, the entire future of altcoin ETFs is at stake, and traders are closely monitoring the upcoming decisions from regulators.

The crypto sector is used to forecasts and bets on the future. But when a probability rises to 81%, it stops being mere speculation and becomes a credible scenario. This is the case with the XRP ETF, whose approval in the year 2025 seems increasingly plausible, according to the bets recorded on Polymarket. While American regulators are still struggling to clarify their position on cryptocurrencies, this sudden rise in forecasts is noteworthy.

The economic divide between the French is widening as wealth concentrates in the hands of a tiny minority. At a time when the debate over tax justice is raging, a recent study by the General Directorate of Public Finances (DGFiP) paints a picture of the 0.1% of the wealthiest French citizens, revealing an increasingly marked fracture with the rest of the population. Who are these 74,500 households that make up this financial elite? What are their incomes, the structure of their wealth, and how has their situation evolved over the past few decades?

The crypto market is going through a period of tension, and the numbers speak for themselves. While Bitcoin is moving in a zone of uncertainty, exchange-traded funds (ETFs) based on the first cryptocurrency are experiencing a concerning wave of withdrawals. In just three days, $494 million has left these investment vehicles, indicating a weakening of buying momentum and a growing climate of caution among investors. The ETFs, which were supposed to bring new stability to the Bitcoin market, are now struggling in the face of an increased downward trend. Between institutional caution and declining investor enthusiasm, the situation highlights tensions that could weigh on Bitcoin's evolution in the coming weeks.

Investors have always viewed gold as a safe haven. But what happens when that very refuge falters? In recent weeks, the gold market has been going through a troubled period, fueling growing distrust among traditional investors. At the heart of the tensions are abnormally long delivery times from the Bank of England and questions about the system's actual capacity to honor its commitments. In the face of this uncertainty, an alternative stands out: bitcoin, a cryptocurrency that escapes logistical constraints and manipulation risks. Jeff Park, an expert at Bitwise Asset Management, has not minced his words, announcing a possible massive capital migration from gold to crypto. A paradigm shift is emerging, with consequences that could reshape global investment.

The crypto industry, once synonymous with financial innovation, is now becoming a prime playground for increasingly sophisticated scams. While 2024 has already been marked by an explosion of digital fraud, Chainalysis sounds the alarm: 2025 could very well be the most lucrative year in history for cybercriminals. Artificial intelligence (AI), once seen as an asset to enhance security, is now becoming a formidable weapon in the hands of fraudsters. Identity falsification, voice impersonation, automation of psychological manipulations... the new strategies of scammers are pushing the boundaries of the possible.

The line between traditional finance and the world of crypto continues to blur. Franklin Templeton, a giant in asset management with $1.6 trillion under management, takes another step towards integrating blockchain and announces the extension of its tokenized US money market fund (FOBXX) on Solana. This strategic move, which comes against a backdrop of rising tokenized financial assets, could represent a turning point in the institutional adoption of this technology. After already launching this fund on Ethereum, Avalanche, and several layer 2 blockchains, the American company is now betting on Solana, an infrastructure that has managed to appeal beyond its initial reputation as a playground for memecoins.

The French are borrowing less and less, an unprecedented trend that raises numerous questions about the country's economic dynamics. For the past six years, the contraction of the credit market reflects both the caution of households and the structural difficulties in real estate and consumption. The rate of credit holdings has fallen to its lowest level in over thirty years, a situation that even exceeds the shockwave caused by the subprime crisis in 2008. However, the first signs of a rebound in 2025 are emerging, fueled by a gradual improvement in households' financial situations.

The BRICS continue to redefine the global geopolitical landscape. As the group expands and seeks to strengthen its influence, its relations with the West become strained. The latest episode: Iran, a new member of the bloc, has categorically rejected any negotiation with the United States. "Negotiating with America does not solve any of our problems," Tehran stated. This is a firm refusal of any diplomatic opening with Washington. This positioning, much more than a simple political statement, illustrates a growing rift between the BRICS and Western powers.