Bitcoin has just experienced an unexpected hiccup: its mining difficulty has decreased for the first time in four months. A fragile breath in an ecosystem accustomed to constant escalation. However, behind this seemingly technical number lies a much more tumultuous story. Amid site closures, rapid updates, and survival strategies, the mining sector is navigating a silent storm. What if this decline were a symptom of a deeper transformation?

Home » Archives for Evans SELEMANI » Page 10

Evans S.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

Holding bitcoin for three years and permanently avoiding capital gains tax? This once-unimaginable scenario is becoming a reality in the Czech Republic. Starting in 2025, cryptocurrency investors will benefit from a full exemption on their capital gains, provided they adhere to a holding period and certain specific rules. This initiative is shaking up the European tax landscape, stirring both the enthusiasm of investors and the questions of experts. What are the stakes of this bold reform? An analysis of a measure with significant implications.

The crypto landscape is undergoing a silent earthquake. As altcoins attempted to rise into the spotlight, a giant regained control: Bitcoin. By the end of 2024, the "altcoin season" had faded, yielding to an overwhelming dominance of BTC. According to Rekt Capital, a respected analyst, Bitcoin could reach a 71% market share before any altcoin revival. A scenario that resonates as a warning for overly optimistic investors. But how did we get here? And what does this dynamic reveal about the evolution of the market?

The crypto market is going through a turbulent period, and altcoins seem far from reaching their December highs. According to analyst Matthew Hyland, it will likely take until April, or even longer, to see a full recovery.

As the crypto ecosystem holds its breath, Ethereum is set to make a historic leap. Slated for March 2025, the Pectra update is not just about fixing bugs or tweaking parameters. It is reshaping the very foundations of the network. Vitalik Buterin, an unending visionary, recently unveiled innovations that could transform Ethereum into a scaling machine and a mainstream ecosystem. But behind the technical promises lies a deeper strategy: to make Ethereum the backbone of an accessible Web3. Here's an explanation.

As the crypto markets struggle under the shock of Trump’s tariffs, a new player enters the scene: David Sacks, the man who whispers to AI and digital assets. On February 4th, this shadow strategist will unveil Washington’s battle plan to regain control of a space in complete chaos. Between historical…

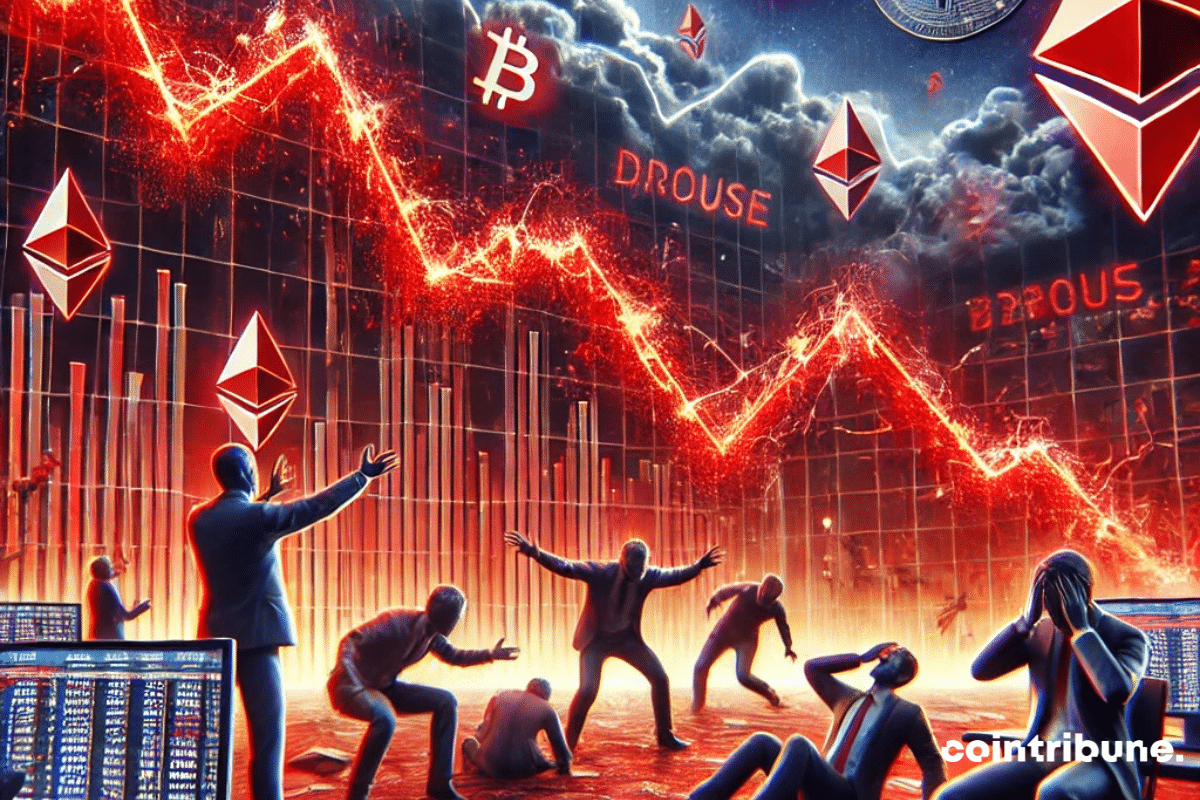

The crypto market has just experienced an unprecedented financial tsunami. In 24 hours, 2.24 billion dollars evaporated under the blows of trade wars, propelling Ethereum to the forefront of a historic debacle. A massive liquidation, driven by Donald Trump's surprise announcement on customs duties, shattered the records of the FTX crisis and the COVID-19 crash. Behind these dizzying numbers, over 730,000 traders saw their positions turned to ashes. How could a political tweet shake a decentralized ecosystem? Let's dive into the machinery of this debacle.

Donald Trump redefines the future of crypto with a decree banning CBDCs and favoring stablecoins. Discover his vision to make the United States a global leader.

With the imminent introduction of XRP and SOL futures contracts by the Chicago Mercantile Exchange (CME), the landscape of cryptocurrency investment is set to undergo a revolution. Get ready to discover what these developments mean.

Rumble, the video-sharing platform, recently made waves in the crypto world by adopting a bold strategy that aligns with that of MicroStrategy. The result? An 80% surge in its stock prices. What lies behind this bet on Bitcoin? And why are companies rushing into this cryptocurrency?

In the world of crypto, it is generally expected that innovation and decentralization go hand in hand. However, a recent controversy surrounding the leadership of Ethereum has shaken this ideal. The departure of a lead developer, Eric Conner, following a public disagreement with Vitalik Buterin, raises new questions about the project's direction.

In the face of the rapid rise of cryptocurrencies, the United States Securities and Exchange Commission (SEC) is finally positioning itself to structure the regulatory framework for this booming universe. On January 21, the official announcement of the creation of a dedicated working group, led by Hester Peirce, marks a strategic turning point. But what are the implications for the future of digital assets and, more specifically, Bitcoin?

Donald Trump's term begins on an unexpected note for the crypto sphere. While many hoped for strong announcements on the first day, the president remained silent on digital assets, plunging the markets into doubt. However, beyond this first day, encouraging signals are emerging.

Bitcoin recently crossed the mythical threshold of $109,000. This new record comes against a backdrop filled with symbols and expectations, as Donald Trump prepares to be sworn in for a second term as President of the United States. A meteoric rise that marks a key moment in the history of cryptocurrencies.

The world of cryptocurrencies continues to shake up the codes of traditional finance. This time, it is the Swiss public bank PostFinance that takes a new step by making Ethereum staking accessible to its 2.7 million clients. A bold initiative that reflects a growing enthusiasm for digital assets in Switzerland…