Between a provocative Trump and an inflexible Fed, the economy wobbles. Interest rates rise, prices soar, and nerves fray.

Archive 2025

Bernard Arnault's fortune, the French luxury magnate and CEO of LVMH Moet Hennessy Louis Vuitton, took a heavy hit in 2024, losing $31.9 billion in a single year due to the drop in stock prices.

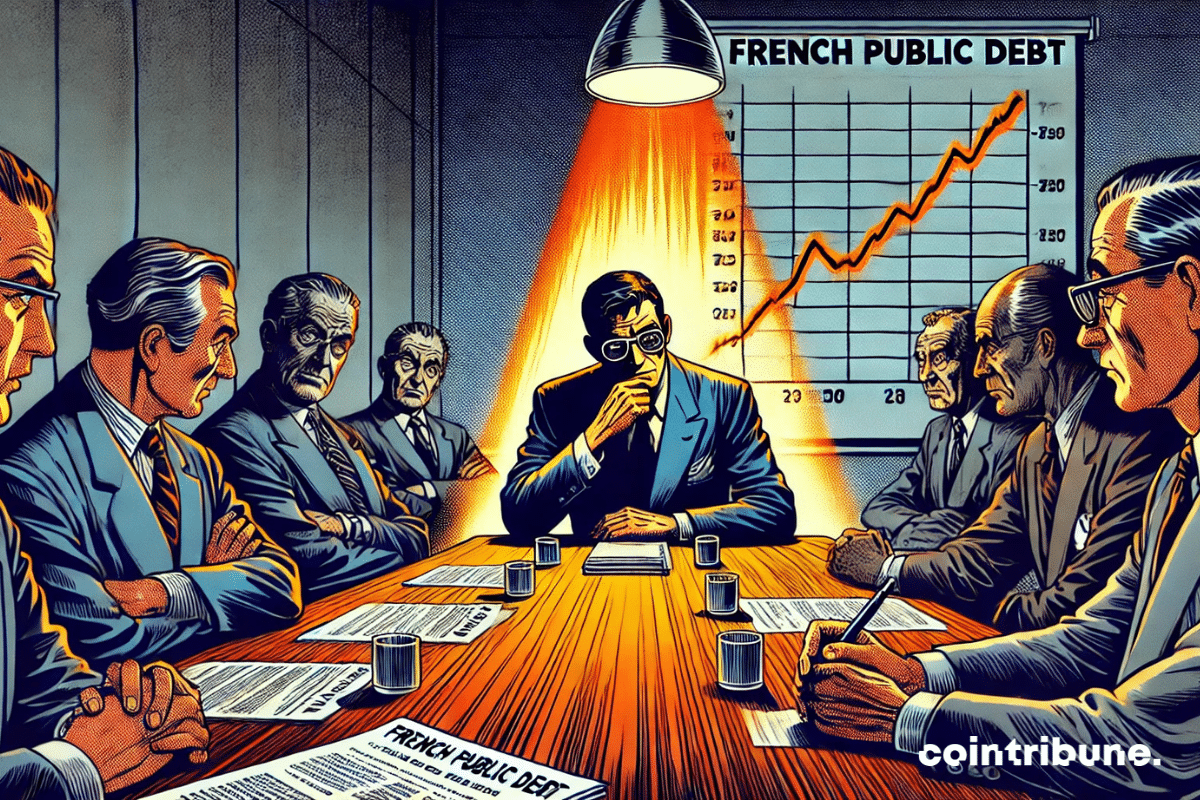

The French state is preparing to face a year of high tension in the financial markets. With 300 billion euros to borrow in 2025, an unprecedented level of debt, Bercy must maneuver in a particularly unstable environment. The French Treasury Agency (AFT), responsible for debt issuance, faces a double challenge: ensuring the financing of the country without destabilizing the markets and reassuring increasingly cautious investors. Indeed, political uncertainty further complicates the situation. Since the fall of the Barnier government, France has been operating without an approved budget, which strengthens doubts about the country’s budgetary trajectory. A special law adopted in emergency allows for the maintenance of borrowing, but this temporary solution is not enough to dispel the concerns. In the markets, signs of instability are multiplying. The spread between French and German rates, a key indicator of investor confidence, has doubled in a year to exceed 80 basis points. This signal reflects a riskier perception of French debt and could increase the cost of financing. In this climate of uncertainty, Bercy must find the right balance. Will the AFT’s strategy, based on predictability, regularity, and flexibility, be enough to avoid an excessive rise in interest rates? With only a few days until the first auctions, pressure is mounting on financial officials, while investors are waiting for guarantees on the country’s budgetary stability.

For the first time in 2025, bitcoin has crossed the $102,000 mark today, marking a significant turning point for the world's best-known cryptocurrency. This spectacular rise is attributed to 4 key factors that have converged to propel the price of bitcoin to new heights.

Vitalik Buterin, co-founder of Ethereum, recently suggested a "soft pause" in the use of computing resources at an industrial scale to slow down the development of potentially dangerous superintelligent artificial intelligence (AI). This proposal, along with other radical measures, aims to give humanity more time to prepare for the risks associated with such technology.

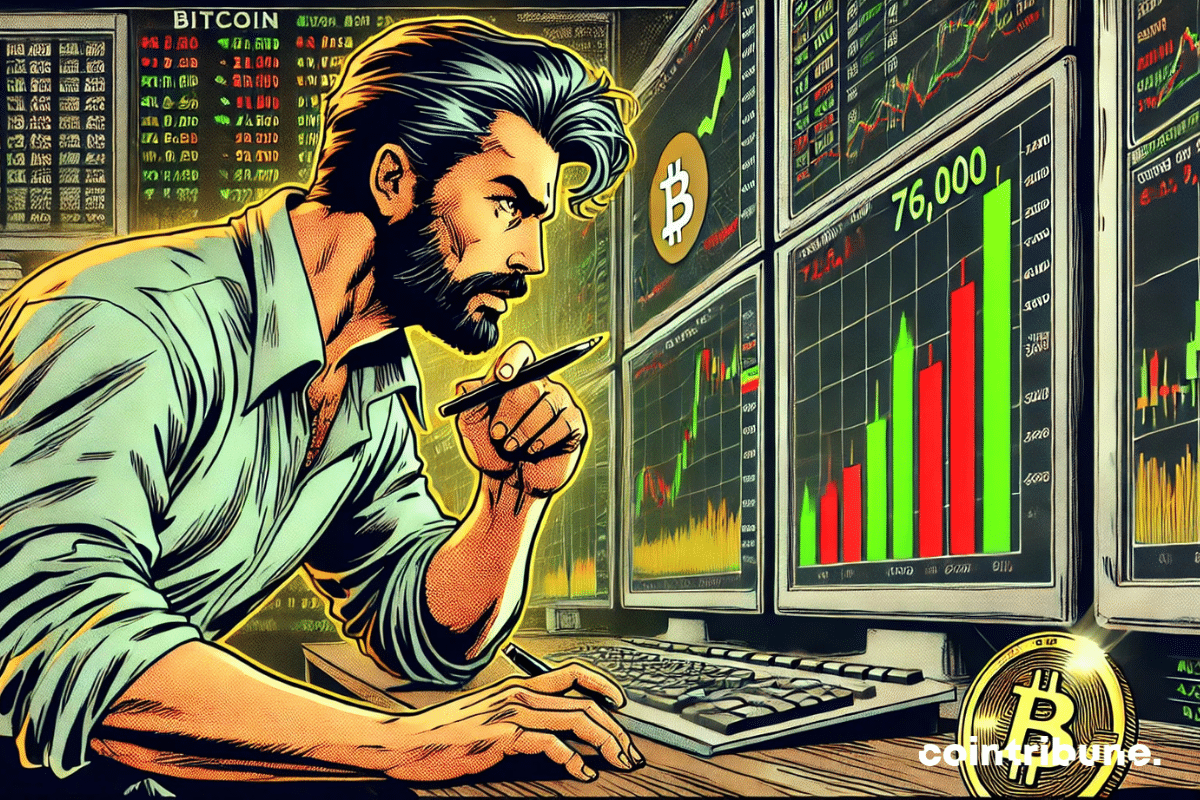

The year 2025 starts on uncertain grounds for bitcoin. After reaching a peak of $108,000, the cryptocurrency quickly lost ground, falling back below the symbolic threshold of $100,000. This level, both psychological and strategic, has become a fragile equilibrium point where buyers and sellers are at odds. On one side, optimists believe this consolidation phase paves the way for a new bullish impulse, with potential recovery towards record levels. On the other side, proponents of a bearish scenario anticipate a more pronounced correction, which could bring BTC down to $76,000, a level corresponding to a key support zone. Beyond these contrasting forecasts, several factors contribute to the uncertainty. Additionally, macroeconomic tensions, particularly the upcoming decisions from the U.S. Federal Reserve (Fed), add further pressure on investors. In light of this uncertain climate, the coming weeks are poised to be critical for bitcoin. The outcome of this battle at $100,000 could well dictate market trends for the remainder of the year.

Between Trumpian euphoria and the cold mechanics of the Fed, bitcoin swings, a fragile king of a kingdom of uncertainties.

Backpack Exchange, a fully regulated cryptocurrency exchange platform on a global scale, announced today the acquisition of FTX EU, the former European branch of FTX holding a MiFID II license. Approved by the FTX bankruptcy court and the Cyprus Securities and Exchange Commission (CySEC), this acquisition represents a major milestone in Backpack's international expansion and demonstrates its commitment to providing secure and regulated trading solutions across Europe.

The price of XRP is currently forming a promising technical setup, supported by a significant increase in open interest and robust technical indicators. Analysts are forecasting an ambitious target of $15 as the crypto market shows signs of increasing strength.

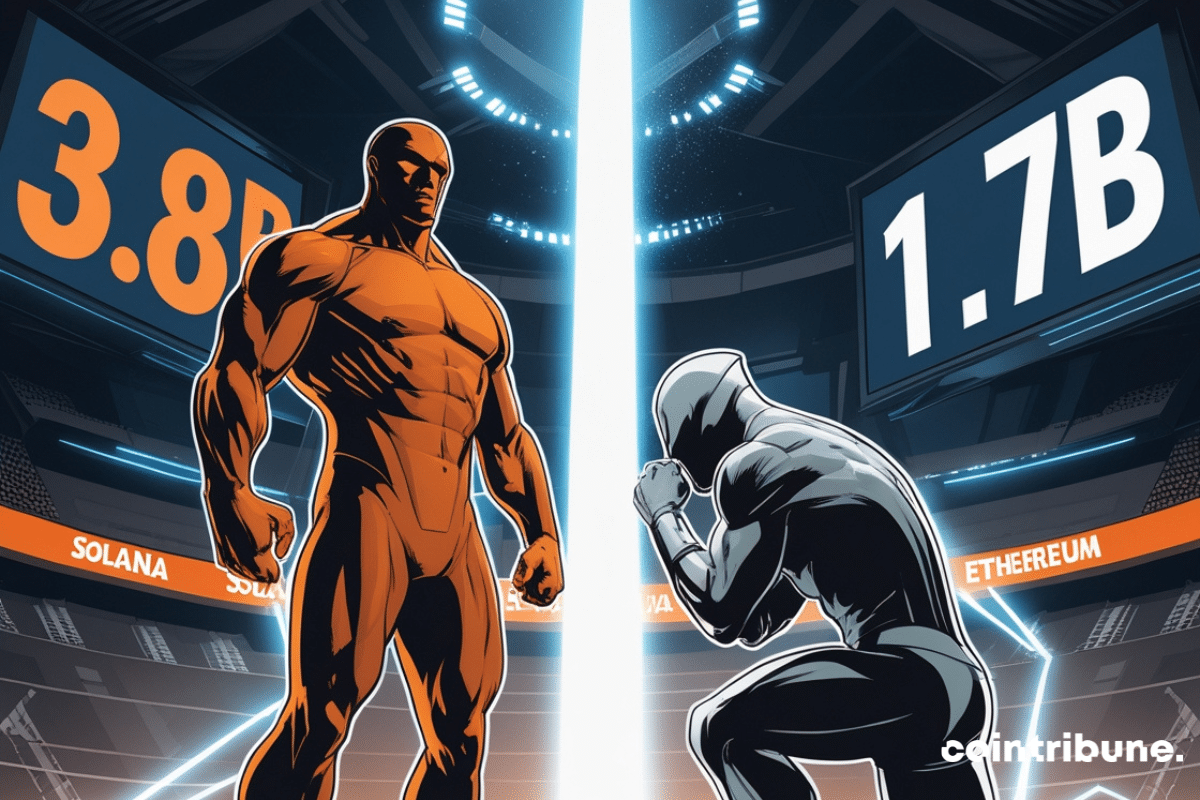

Solana, the audacious blockchain, humiliated Ethereum in broad daylight: 3.8 billion in 24 hours, leaving its rivals stunned. A memorable slap in the crypto arena.