The billionaire Trump has transformed his setbacks into financial levers. Thanks to Truth Social and his crypto projects, he is multiplying his wealth by playing with expectations and speculations.

Archive April 2025

The sentiment for bitcoin is at its lowest since the beginning of 2023. However, several analysts are identifying encouraging signs of a possible change in momentum as the queen of cryptos shows remarkable resilience in the face of recent volatility in the US stock markets.

Bitcoin may soon have to sacrifice some of its coins to survive the quantum era. In the face of the growing threat from quantum computers, a radical plan is on the table: to permanently burn thousands of bitcoins. This controversial project, called QRAMP ("Quantum-Resistant Address Migration Protocol"), proposes a hard fork to secure the network at the cost of a partial destruction of non-migrated BTC. The Bitcoin community must now choose between immediate security and absolute adherence to the original principles of cryptocurrency.

The sudden calm that falls over a network as active as XRP is never trivial. After a stunning rally at the end of 2024, Ripple's blockchain is experiencing a plunge in its activity. This drop of 65% in just a few weeks is more than just a simple adjustment. It reveals a worrying loss of momentum and raises questions about the strength of the market. Behind the numbers, an entire speculative dynamic seems to be wavering.

Bitcoin shows a surprising resilience in the face of market collapse. While gold retreats, it rises alone toward $100,000, fueled by a breakthrough narrative.

The mysterious creator of Bitcoin, Satoshi Nakamoto, celebrates his 50th birthday today, as his innovation revolutionizes global finance and now attracts major economic powers.

In a geopolitical context undergoing a major reshuffle, two significant initiatives are shaking the hegemony of the dollar. Brazil and China are making a strategic shift by favoring their national currencies for bilateral exchanges. For their part, Russia and Iran are announcing the launch of a new common currency to circumvent Western sanctions. These distinct yet converging movements illustrate a shared desire among influential BRICS members: to build a financial system that is less dependent on the greenback and to assert monetary sovereignty in the face of external pressures.

A historic day on Wall Street: on April 4, 2025, American markets lost $3.25 trillion, more than the total market capitalization of crypto. This brutal drop, triggered by tariff measures from Trump, reveals a deep crisis. Bitcoin, however, endures. An analysis of an economic shift.

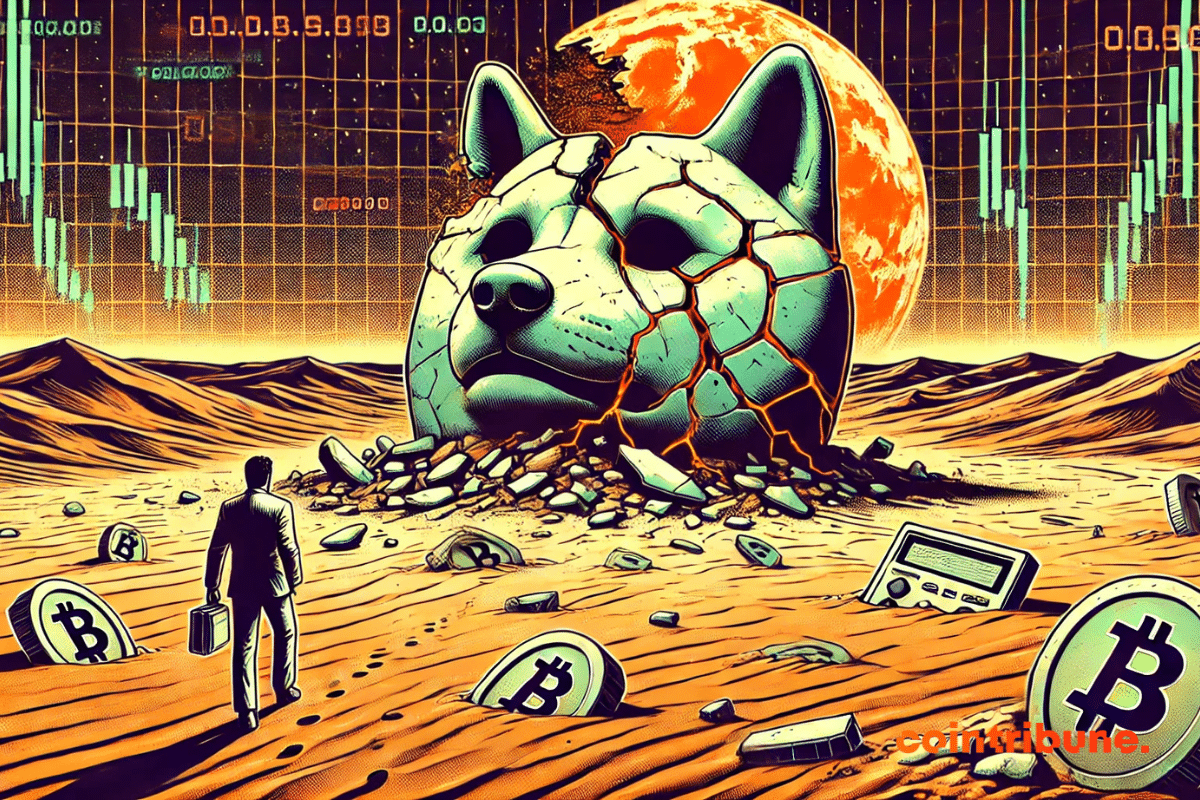

Experienced traders continue to show interest in memecoins despite the obvious signs of exhaustion in the speculative market for these particular cryptocurrencies.

Behind the overwhelming losses of SHIB wallets, the infrastructure still roars. Between discouragement and rumors of resurgence, the ecosystem slowly burns, ready to reignite the speculative flames.