Transaction fees in bitcoin have skyrocketed in recent days due to what is known as "mempool congestion".

Archive December 2023

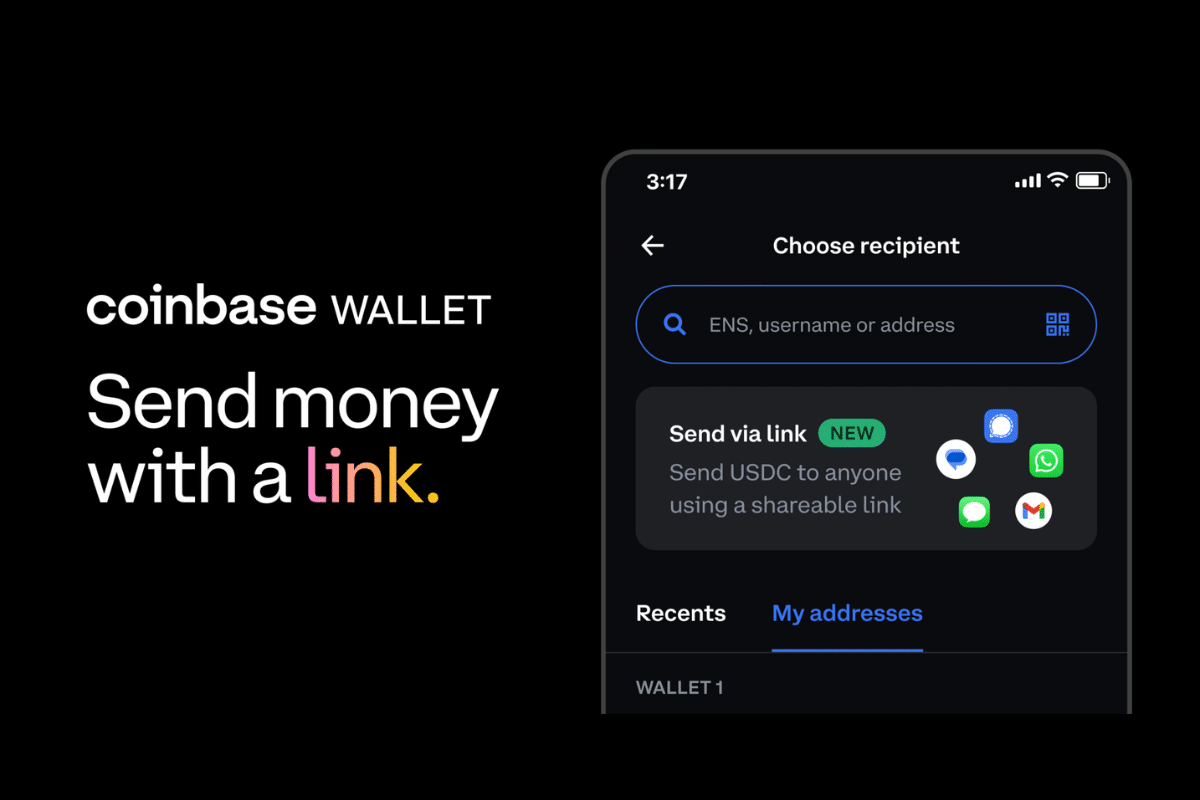

"Coinbase is revolutionizing crypto payments on social networks. Discover how this new service works in this article."

The Bitcoin network is experiencing unprecedented congestion in recent days, caused by a massive influx of transactions related to BRC20 tokens. Nearly 300,000 transactions are waiting to be confirmed, saturating miner memory and driving fees to record levels.

Since January 2023, bitcoin (BTC) has experienced several breakthroughs that have caused its value to skyrocket. The asset has repeatedly reached the $30,000 mark. A resistance level that it vigorously broke through to reach the $40,000 mark, double its price at the beginning of the year. The asset is currently trading around $43,655 after a 4.52% increase in the last 24 hours. Bitcoin (BTC) is showing a level of dynamism that we haven't seen in several months. However, in this context, some financiers believe that all the hype surrounding the flagship cryptocurrency is biased. Let's see in the following lines what this is all about.

Bitcoin is in a state of euphoria. Driven by growing enthusiasm from professional investors, bitcoin has just surpassed the $44,000 mark, dangerously approaching its all-time high set just one year ago. A telltale sign is the explosion in the volume of futures contracts traded on dedicated platforms. Here's the explanation.

Every economic ecosystem has a circle of people pulling the strings in some way to influence decisions. This is the mission of lobbyists, and there are many in the American crypto industry. Recent data shows a clear increase in funds injected by them to promote crypto activities.

Bitcoin has long played the role of the undisputed leader, paving the way for its crypto brethren. But, as in any good epic tale, a challenger arises: Ethereum. As we approach the end of 2023, we might be witnessing the dawn of a new era, where the altcoin is no longer content to follow but aims to compete. Is it the season of altcoins? In this financial ballet, Ethereum sketches a daring dance to catch up with the Bitcoin giant. Let's analyze this captivating plot together.

Every crypto enthusiast has some interest in the concept of tokenizing real assets. The idea is not new in itself. But its emergence marks a profound revolution in the crypto ecosystem. Because it introduces an innovative perspective, regarding the relationship between the digital and the real. In this article, we explore the underlying mechanisms of tokenizing real assets. This, by highlighting the way this technology increases not only accessibility and liquidity. But above all, strengthens the legitimacy of the blockchain-based industry by integrating elements from the real world into its digital fabric.

Bitcoin, consistently in the spotlight, has recently been the subject of a sharp analysis by John Bollinger, an authority on trading.

Already criticized for its high level of centralization, Ethereum is disappointing many by censoring several transactions not validated by the OFAC.