In 2017, Larry Fink, CEO of asset management company BlackRock was scathing about bitcoin. In particular, he criticized the crypto queen as a mafia asset, useful for laundering money. Now, his views on bitcoin's usefulness have changed dramatically.

Archive July 2023

For the time being, Gary Gensler is untouchable. He will continue to reign supreme in the offices of 100 F Street, NE Washington D.C. Especially in the absence of solid arguments against his policies. Yet the crypto community has never stopped finding a breach in the SEC's fortified line. Perhaps this latest initiative by pro-crypto lawyers will eventually succeed?

According to various data, the first half of 2023 is marked by a significant rise in crypto market capitalization. Just the thing to spark renewed investor interest after a year marked by scandals!

It's not the first time that financial giants have made optimistic statements about bitcoin. But this time, the CEO of the world's largest asset management company openly declared his preference for bitcoin “over investing in gold, […] bitcoin is an international asset”. In the wake of this statement, bitcoin is on the verge of a bull market. As stock market indices consolidate, bitcoin is on its highest levels of the year. But is bitcoin “digital gold”? And what are the aims of this financial giant?

Over the past week, Litecoin has risen by more than 30%. The LTC price tested $116, marking a new annual ATH.

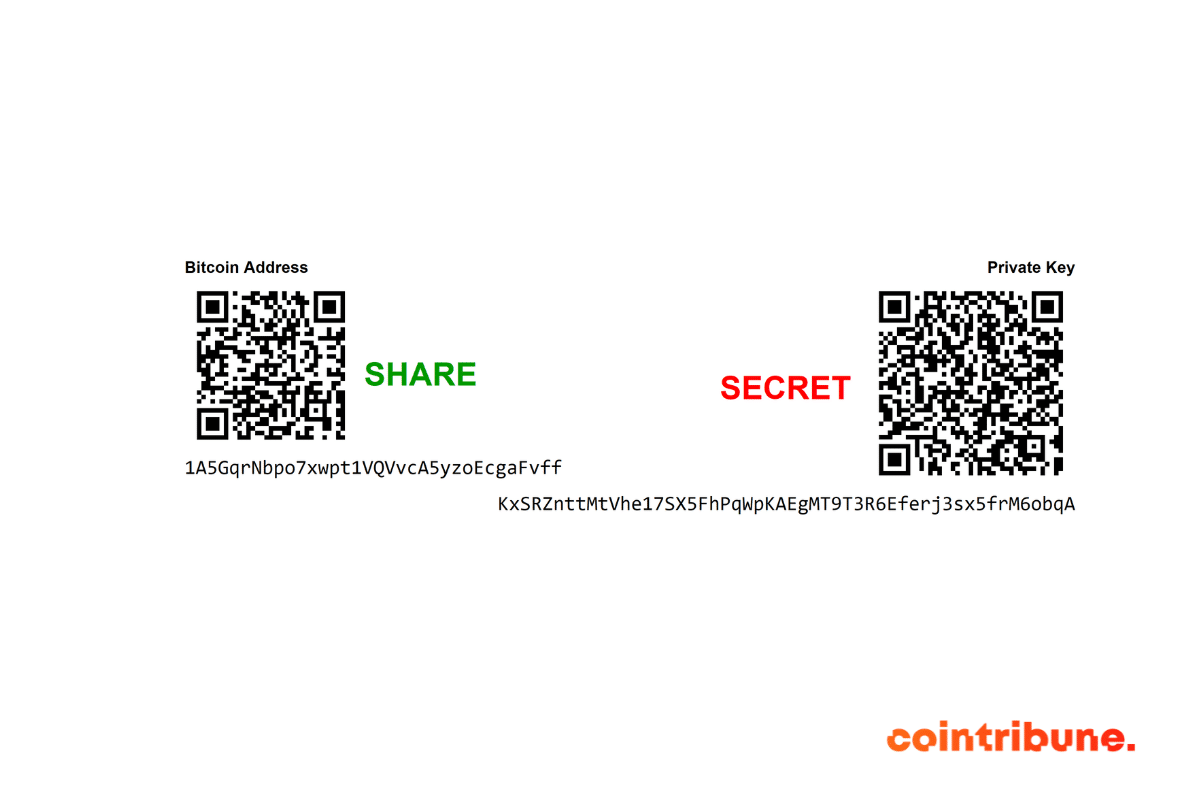

The concept of a key frequently appears in the cryptocurrency world due to its crucial role in managing a crypto wallet. Indeed, a person truly owns bitcoins only when they are the sole holder of their private keys. Therefore, you must keep it secure if you possess one. In this article, we invite you to dive into the fascinating world of Bitcoin private keys and their secure management. Our journey will include understanding fundamental concepts, various types of wallets available, and optimal storage methods. From a broader perspective, we will also provide essential Bitcoin security tips to effectively protect your valuable digital assets. Dans le cadre de cet article, nous vous invitons à une plongée au cœur du monde fascinant des clés privées Bitcoin et de leur gestion sécurisée. Notre parcours inclura la compréhension des concepts fondamentaux, les divers types de portefeuilles disponibles, ainsi que les méthodes optimales de stockage. Dans une perspective plus large, nous vous fournirons également des conseils sécurité Bitcoin [Insérer lien Page mère Conseils Sécurité Bitcoin] essentiels pour protéger efficacement vos précieux actifs numériques.

The security of digital assets is a major concern for investors. That’s why many Bitcoin holders choose to use a hardware wallet, or hard wallet, to store their cryptos with peace of mind. Discover our review of the most popular and effective hard wallets for securing your bitcoins, ethers, and other cryptocurrencies, along with their features, advantages, and disadvantages.

With the rapid evolution of the crypto industry, the security of digital assets has become a major concern for holders of Bitcoin and other crypto assets. Soft Wallets have become essential tools for storing and managing your digital currency. However, with the number of options available in the crypto market, selecting a Soft Wallet is not that simple. Discover our complete guide to digital wallets for cryptocurrencies.

Experiencing the loss of your Bitcoin account is one of the most frightening nightmares for a cryptocurrency investor. However, in the face of this perplexing situation, there are effective strategies you can deploy to fully recover your data and protect your assets. Whether it's a connectivity issue, the loss of your private keys or passwords, or even if you have been the target of phishing or hacking attacks, don’t panic. Follow the Bitcoin security tips that we will detail in this guide. They will provide you with pragmatic solutions to safely regain access to your valuable bitcoins.

The recent disclosure of Hinman's documents reversed expectations of a Ripple victory against the SEC. Despite this, some believe the firm's native crypto has significant upside potential.