MEXC, one of the leading crypto trading platforms, is launching its New Year Futures competition with a prize pool of 8 million USDT! This competition gives traders from around the world the opportunity to showcase their skills and kick off 2025 in style.

Archive January 2025

In its latest blockchain letter, Pantera Capital states that Donald Trump's upcoming inauguration should propel Bitcoin to new heights. The asset manager refutes the application of the stock market adage "buy the rumor, sell the news" to the crypto market, as Bitcoin currently hovers around $95,000.

Global economic relations are evolving under the influence of geopolitical tensions and the strategic repositioning of major powers. In this context, China and Russia are strengthening their trade partnership, which is set to reach a historical record of 240 billion euros in 2024. This growth illustrates a strategic rapprochement bolstered by Western sanctions against Moscow and Beijing's desire to expand its influence. More than just an economic alliance, this cooperation sends a clear signal to the United States and the European Union, which aim to limit their dominance on the global stage. Thus, the surge in trade flows, increased use of the yuan in transactions, and the restructuring of international financial circuits now raise the question of the long-term consequences of this Sino-Russian agreement.

Cryptos have been evolving for years in a regulatory gray area, but the latest decision by the U.S. Supreme Court marks a decisive turning point for Binance. By rejecting the platform's request, the highest American court confirms that securities laws apply to transactions conducted on its servers, even if the company does not have a physical headquarters in the United States. This verdict paves the way for a class action lawsuit initiated by investors, who accuse Binance of selling unregistered cryptos. Already under pressure after a series of lawsuits and a multi-billion dollar settlement with the Department of Justice, the exchange and its former CEO, Changpeng Zhao, are facing intensified legal challenges. This setback raises a key question: Are the United States imposing their authority over the entire global crypto market?

The entertainment giant Sony has taken a major step in the blockchain universe with the official launch of Soneium, its Layer 2 platform on Ethereum. After four months of successful testing that attracted over 14 million users and processed 47 million transactions, this initiative marks a turning point in the adoption of blockchain by entertainment giants.

While the American economy soars like a star, Europe gets lost in a maze of rules and bitter regrets.

Elon Musk, strategist or fraudster? The SEC strikes, Musk retaliates: a financial spectacle where 150 million fuels the media blaze.

The 2024 American presidential election has sparked numerous debates, particularly regarding the potential influence of crypto. Gary Gensler, the outgoing chairman of the Securities and Exchange Commission (SEC), recently stated that cryptocurrency did not play a decisive role in the outcome of this election. Therefore, will it be abandoned by the Trump administration?

The year 2025 marks a decisive step for the crypto market. Indeed, regulatory pressure is intensifying, while institutions are strengthening their presence in the sector. In this rapidly changing environment, some projects manage to stand out by combining innovation with strategic adoption. For investors, identifying the most promising altcoins relies on several criteria: scalability, institutional adoption, technological performance, and return potential. Thus, among the most strategic choices for January 2025, Solana (SOL), Cardano (ADA), and Avalanche (AVAX) stand out due to their optimized infrastructures and growing adoption, thereby consolidating their place at the heart of Web3.

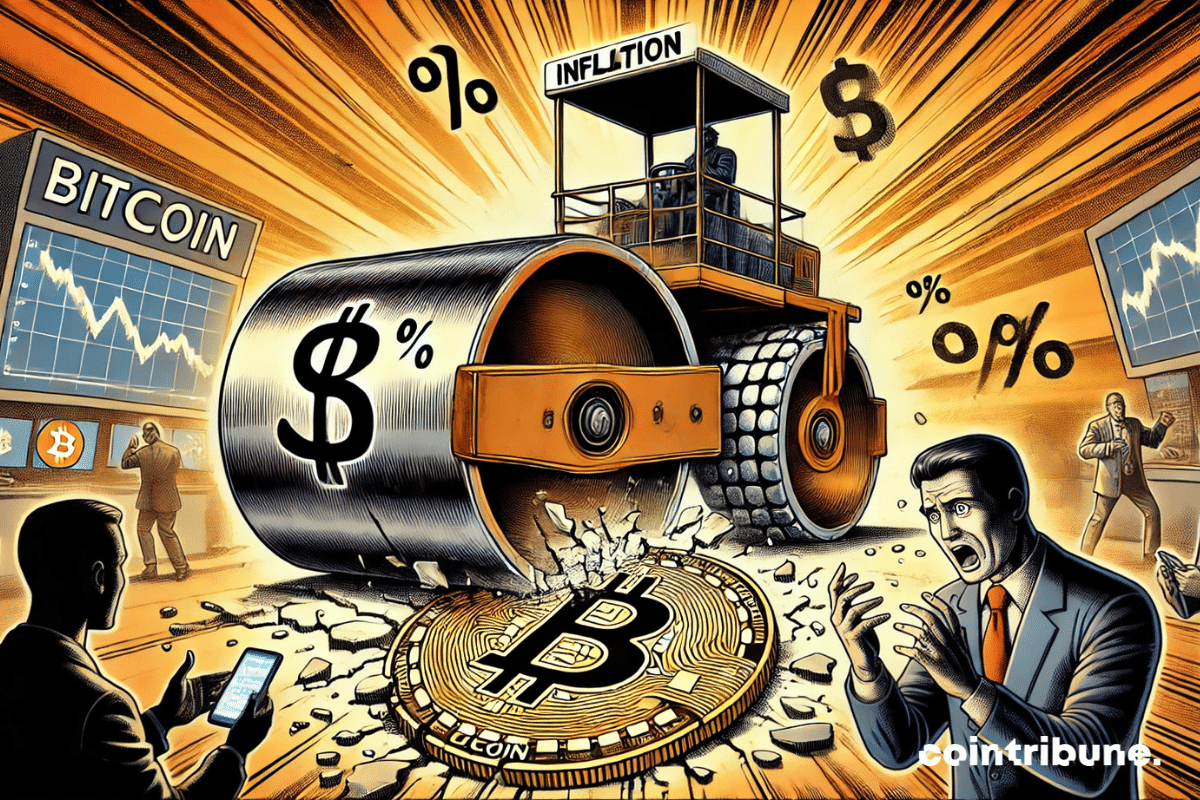

After reaching a historic peak in December, Bitcoin is undergoing a brutal correction, losing nearly 10% of its value in just a few weeks. This drop cannot be solely explained by a simple market cycle, but by a tense economic context. Persistently high U.S. inflation reduces the Federal Reserve's (Fed) maneuvering room, delaying hopes for rate cuts. This situation increases the pressure on risky assets, including Bitcoin, which sees its appeal diminish against a rising dollar and increasing bond yields. The imminent announcement of the Consumer Price Index (CPI) on January 15 could further accentuate this trend. According to Steno Research, inflation exceeding expectations could trigger new liquidations, potentially pushing BTC below $85,000. However, the danger does not come solely from macroeconomic data. The Bitcoin derivatives market remains overheated, fueling an excess of leverage that increases volatility. Amid economic uncertainties and the fragility of speculative positions, crypto operates in a zone of instability where each economic announcement could provoke a significant movement.