In the fourth quarter of 2025, Tether's USDT recorded historic on-chain activity, with 4.4 trillion dollars transferred and 2.2 billion transactions. While the overall cryptocurrency market underwent a sharp contraction, the USDT market cap reached a record 187.3 billion dollars, driven by massive retail adoption and a user base exceeding 534 million worldwide. Tether thus confirms its growing role as a stable and reliable financial infrastructure.

News

Two Democratic senators demand an urgent investigation into undisclosed Chinese investments in SpaceX. As Elon Musk has just merged his space giant with xAI for $1.25 trillion, Washington wonders: what if Beijing had already set foot in the most sensitive technologies of the United States?

Ether has fallen below $2,000, confirming a marked retracement phase. Indeed, the movement is accompanied by a visible disengagement of holders, an influx toward exchanges, and degraded technical signals. This threshold break tests the market structure and investor resilience.

Crypto: Aster launches its layer-1 blockchain on testnet. A new step towards a trading-oriented infrastructure. All the details here!

The crypto market has sharply declined. In a few hours, major assets lost several months of gains, bringing bitcoin, Ethereum and Solana back to forgotten levels. After the 2025 momentum, investors hoped for consolidation. Instead, a wave of panic took over. More than 2 billion dollars were liquidated, revealing an atmosphere of extreme fear. The entire ecosystem is affected, from tokens to listed stocks, indiscriminately.

Gemini, the crypto exchange founded by the Winklevoss brothers, exits international markets, downsizes, and now bets on prediction markets, a booming sector, with a risky but strategic wager.

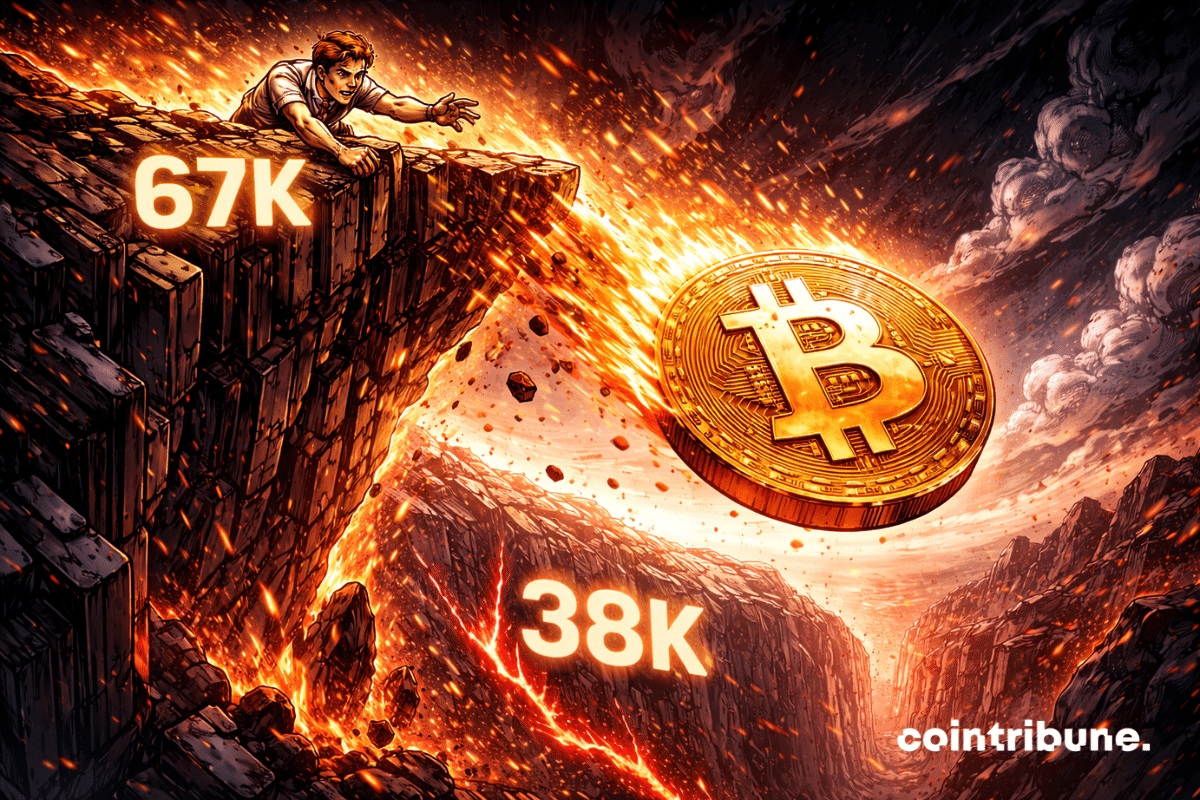

Bitcoin wavers below 67,000 dollars and concern is rising. In an already fragile context, Stifel bank issues a severe warning: a return to 38,000 dollars is now possible. Such a retreat, over 40% decline, would far exceed usual corrections. This scenario, supported by technical and macroeconomic signals, brings crypto market volatility back to the forefront. And this time, it is no longer a mere warning.

Washington on loop mode: crypto lobbies offer keys to local banks, but the Senate still hesitates. Towards an unlikely alliance to save the law? To be continued...

The debate over online age verification intensified this week after Telegram co-founder Pavel Durov criticized Spain’s proposal to restrict social media access for users under 16. Spanish officials say the measure is designed to protect children online, but critics argue it could expand government surveillance and erode digital privacy. The plan has drawn particular concern from the public, who warn of broader consequences for anonymous communication online.

Anthropic’s new AI tools shook software and tech stocks, sparking a market selloff as investors reconsider the impact of automation.

The Kraken exchange platform has just unveiled DeFi Earn, a feature that promises to democratize access to decentralized finance rewards. Launched on January 26, 2026, this innovation allows users to generate up to 8% variable APY on their euros, dollars, and USDC, without having to master the technical subtleties usually associated with DeFi.

Bitcoin’s price remains under strain as selling pressure continues to weigh on the market. The OG coin fell to an intraday low of $72,945 in the previous session as market pullback continues across risk assets. While retail traders have largely maintained bullish positions, institutional investors have begun to retreat. Current data points to a growing divide between these two groups, raising questions about where Bitcoin may head next.

Gold recovered to 5,000 per ounce after a historic drop, with major banks including J.P. Morgan forecasting further gains later in 2026.

BBVA joins a banking consortium to launch a euro stablecoin against dollar stablecoins. All the details in this article!

Binance creates a staggering gap. CoinMarketCap's Proof of Reserves report reveals overwhelming domination: $155.6 billion in assets, far beyond any other platform. As transparency becomes a vital requirement in a market under regulatory pressure, this ranking raises a crucial question: who can be trusted today? Binance establishes itself decisively.

Crypto.com bets big on a crypto prediction app with up to $500 offered at sign-up. Discover the details in this article.

While the crypto market remains without a clear direction, XRP attracts attention. According to analyst XForceGlobal, the token has entered a "washout zone," an intense correction phase potentially preceding a major reversal. Relying on Elliott wave theory, he suggests a scenario where the current drop precedes a surge up to 30 dollars. As selling pressure intensifies and technical signals blur, this interpretation divides opinion.

Bitcoin is sliding, ETFs are fleeing, Binance is coughing, traders are tensing up. And we were told that cryptos were rock solid...

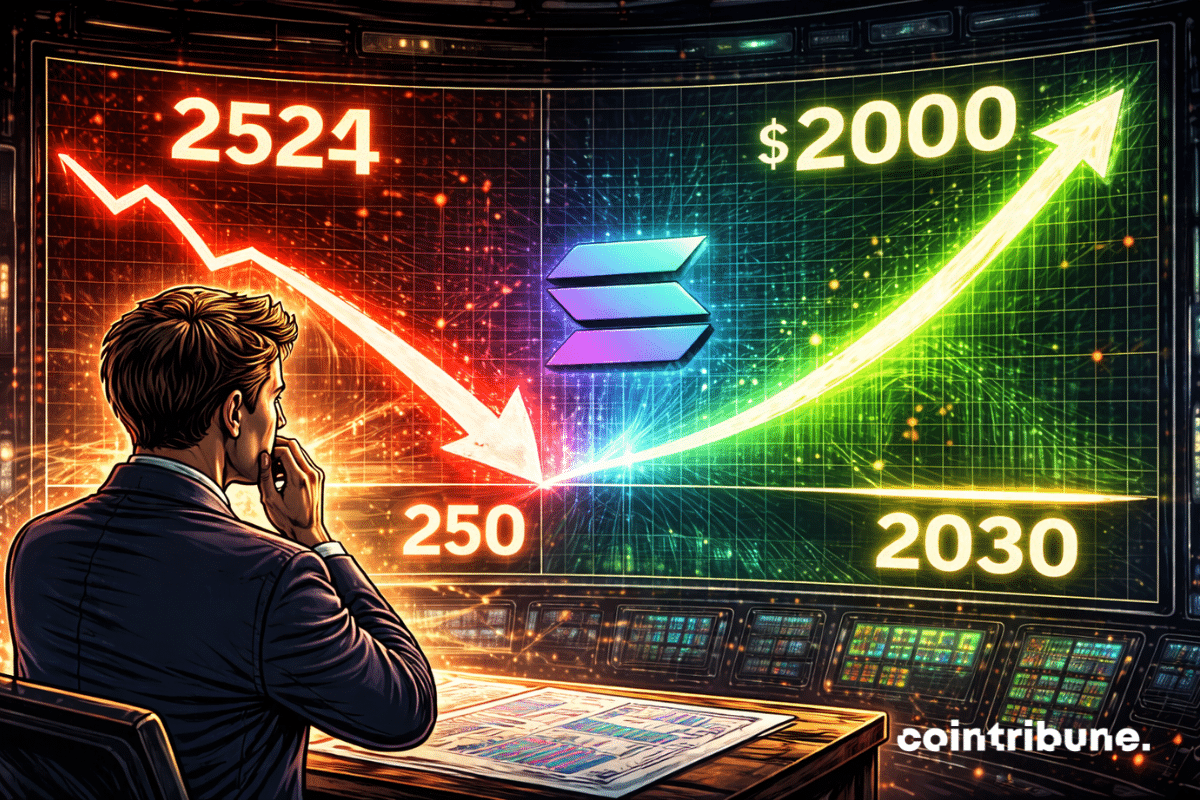

The crypto market has just received a strong signal from traditional finance. By sharply revising its forecasts for Solana, the Standard Chartered bank caused a shock in the ecosystem. While SOL remains one of the most watched assets by institutional investors, the lowering of the target for 2026 contrasts with a spectacular long-term projection. This decision reveals a much more nuanced reading of the future of blockchain than simple price movements suggest.

While bitcoin showed its worst performance since 2022, a massive capital movement was preparing in the shadows. Stablecoin volumes reached 10 trillion dollars in January, nearly a third of the annual activity of 2024 concentrated in just 30 days.

When Vitalik scolds his L2 children, Arbitrum, Optimism and Base reply: "Papa Ethereum is aging, but we remain indispensable!" A technical... and existential dispute.

For years, blockchain conferences have been dominated by crypto-native narratives. Protocols talking to protocols, builders talking to builders. Paris Blockchain Week 2026 takes a different approach.

Tether claims a valuation of 500 billion dollars, but investors remain skeptical. Between reduced fundraising, announced profits, and regulatory challenges, the company divides opinion. Dive behind the scenes of a stablecoin that defies the market and questions the future of crypto.

Nevada regulators have stepped up action against crypto-linked prediction markets. A new lawsuit targets Coinbase over alleged unlicensed sports wagering. The move comes as prediction platforms expand quickly across the United States. State officials argue that existing gambling rules still apply, even when products are offered through crypto or derivatives markets.

Markets may be mispricing how sharply U.S. interest rates could fall if Kevin Warsh becomes the next chair of the Federal Reserve. A new forecast points to rapid and sizable rate cuts—an outcome that could weaken the dollar and reignite risk assets, including Bitcoin.

In 2026, family offices massively bet on AI, leaving crypto behind. With 89% of them having no exposure to digital assets, the gap widens. Why such an imbalance? What are the risks and opportunities for investors?

Vitalik Buterin turns a page in Ethereum's history. In a published post, the protocol's cofounder calls into question the strategic vision of Layer 2, long considered the key to the network's scalability. For him, the rollup-centric model no longer delivers on its promises. As Ethereum continues its transformation, Buterin calls for a profound rethinking of the role of second-layer solutions. This stance could well redefine the future of the ecosystem.

Billions unlocked in emergency: Congress attempts to revive the American economy. Discover the details in this article.

It fell back below $74,000 on February 2, Bitcoin suddenly erases gains recorded since Trump’s 2024 election. This sharp decline occurs in a climate of widespread distrust towards risky assets, as selling pressure intensifies. After a peak close to $126,000 reached at the end of 2025, the market now questions the strength of the bullish cycle and leaves doubt over the continuation of the movement.

When Elon Musk's AI imagines itself as a scandal artist, French justice arrives. Grok draws too well... and especially where it shouldn't.