The forecasts of major financial institutions are often scrutinized closely by investors. Indeed, when a renowned bank like Standard Chartered drastically lowers its price target for Ethereum (ETH), the news does not go unnoticed. From a marked optimism of 10,000 dollars for 2025, the bank has reduced its estimate to 4,000 dollars, which is more than a halving of its previous anticipation.

News

When some dig, others pillage: while Bhutan mines Bitcoin, Lazarus steals it. A robbed Bybit, an inflated treasure, and Pyongyang becomes one of the kings of crypto loot.

A recent study reveals that all leaders of small and medium enterprises are now aware of cryptocurrencies, and more than a third personally invest in them, despite still limited professional adoption.

Google officially launched Android 15 on March 17, 2025, and this new version is set to be one of the biggest evolutions of the mobile operating system. Initially scheduled for October 2024, the final public version of this major update brings impressive improvements that will change the way we use our smartphones. Here are the 7 most revolutionary features of Android 15.

Amid revolutionary announcements, technological evolutions, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic challenges. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Tesla, once a star of the roads, is now heading towards the abyss: in France, outraged bosses and emptied fleets are signing the commercial death certificate of King Musk.

Buying a property without a significant down payment is an increasingly difficult challenge, especially for first-time buyers. While mortgage rates continue to exceed 3%, and new prices remain high despite the crisis, the government is expanding access conditions for zero-interest loans (PTZ) starting from April 1, 2025. This is a new initiative that pertains to two lesser-known schemes that allow purchasing a home at a lower cost and spreading out the acquisition.

As of March 17, 2025, Tisséo allows residents of Toulouse to pay for their bus, metro, tramway, and cable car tickets in cryptocurrency. This initiative, a first for a European transport network, aims to diversify payment methods and keep up with the evolution of financial practices.

The crypto market starts this week under pressure, with a notable drop in Bitcoin and more! According to recent data, BTC has lost 2% in the last 24 hours, leading to a broader decline in the market, where major altcoins have crashed. What is happening? What does this week hold for us?

A crypto whale bet $368 million against bitcoin, already raking in $2 million in profits despite enormous risk ahead of crucial Fed decisions this week.

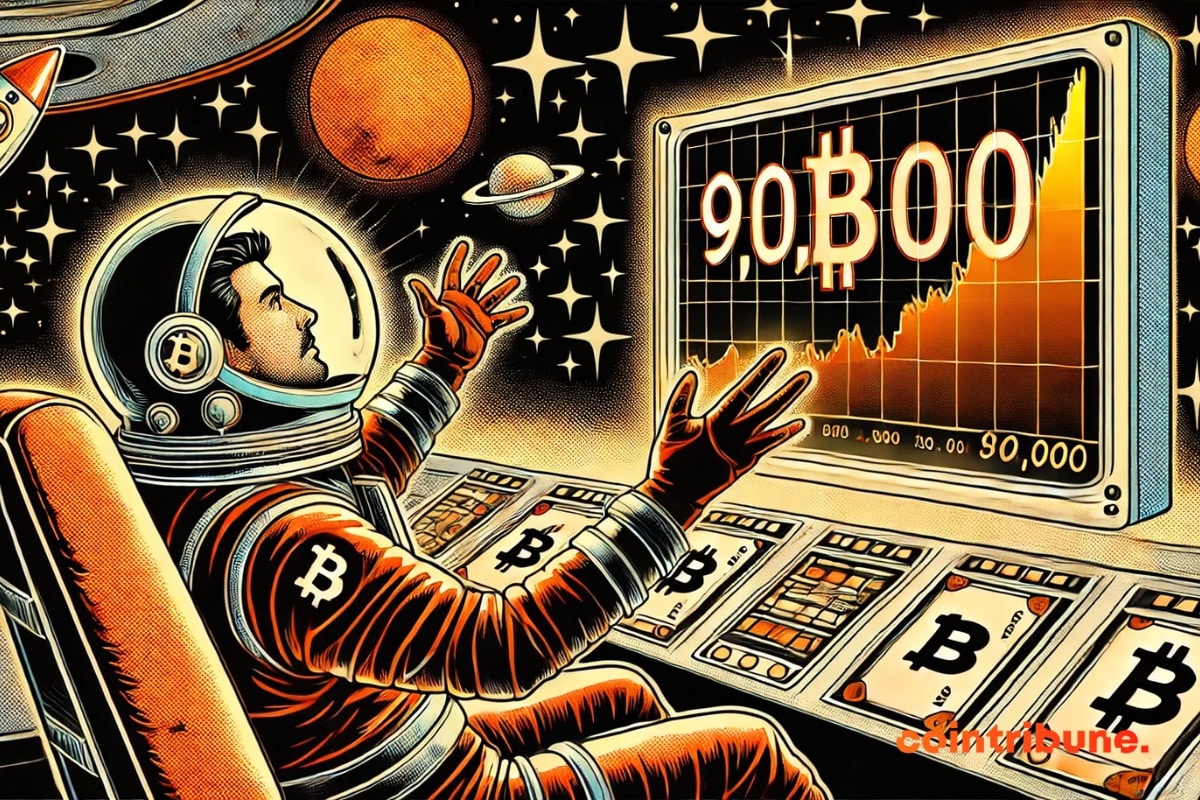

As the crypto market shows signs of consolidation, a recent analysis suggests that Bitcoin could reach $126,000 by June 2025. Currently, BTC is trading at the lower end of its historical seasonal range, but several indicators suggest a strong return of the bullish market and the achievement of a new ATH!

The USA-Ukraine summit was recently held in Riyadh and resulted in more ambitious ceasefire proposals than expected. "The ball is now in Russia's court" has become the American talking point on this issue. Meanwhile, Europe appears to be accelerating its military reassertion in an increasingly tense geopolitical context.

For several weeks now, bitcoin has been swaying. A drop of 22% from its historical peak at $109,000 in mid-January is fueling doubts. Is this the end of a four-year cycle, deeply embedded in the crypto market's DNA, or just a simple turbulence before a new surge? Analysts lean towards the latter option, but the nuances deserve to be explored.

XRP, this rebellious insurgent, rises from the ashes while Ethereum stumbles. The crypto-sphere holds its breath: the established order wavers, and the throne of altcoins threatens to change hands.

Financial markets are wobbling, investors are worried, and cryptocurrencies are undergoing another unstable period. At the heart of this turmoil, one name keeps coming up: Donald Trump. According to several analysts and market observers, the American president is allegedly pursuing a strategy aimed at deliberately weakening financial markets in order to pressure the Federal Reserve (Fed) to lower interest rates. A hypothesis that, while dramatic, is based on public statements and concerning economic signals.

The crypto market is going through a turbulent period marked by a brutal correction of bitcoin and massive capital outflows. With a decline of over 18% from its historic peak of $106,000 in December 2024, some investors are already talking about the most painful cycle in bitcoin's history. However, for seasoned players in the industry, this scenario is nothing new. Even darker periods have marked the evolution of the crypto market, and many see this correction as a temporary adjustment rather than a lasting collapse.

The memecoin market is going through a tough time, and Pepe (PEPE) is no exception. While most cryptos are showing a slight recovery, PEPE is the only memecoin down in the last 24 hours. A performance that could signal the beginning of the end for PEPE!

The shadow of an economic storm looms, tinged with bright red and unpredictable pragmatism. The "Trumpcession" – this neologism that sounds like a warning – encapsulates the growing concern over a trade war with unforeseen consequences. Caught between stimulus and restriction, the Fed and the Bank of England are stuck between rates to adjust and a threatening inflation. How to avoid the domino effect? The answer requires more than an economics manual: a tactical boldness.

As central banks around the world run out of steam in an endless race of monetary printing, François Asselineau, president of the UPR, proposes a radical shift: integrating 5 to 10% of Bitcoin into the reserves of the Bank of France. An idea that shakes traditional economic certainties and questions our relationship with sovereignty. Behind this proposal lies an undeniable observation: Bitcoin is not just a simple cryptocurrency, but a tool of resistance against the erosion of financial freedoms.

They were said to be dead, those brave SHIB. But the team is barking, burning tokens in batches and preparing a revenge that could bite much harder than expected. It's going to bleed!

Bitcoin, fueled by post-election euphoria, reached a peak of $108,000 before falling below $80,000. Global economic instability and rising trade tensions contribute to increased volatility. Despite pro-crypto rhetoric, Donald Trump is adopting a protectionist policy that worries investors. Amid fears of recession and monetary uncertainty, the crypto market wavers in the face of macroeconomic turmoil.

Bitcoin is currently showing signs of recovery after a period of high volatility. Despite a 30% drop from its historic peak in January, the queen of crypto seems to be finding some stability. Several key factors are emerging, suggesting a return of BTC to $90,000 in the coming days.

The evolution of the financial market is following an increasingly digital trajectory, and NFT Bonds (tokenized bonds in the form of NFTs) are emerging as a major innovation. In a world where blockchain is redefining access to financial instruments, players like Credefi are taking a pioneering role by integrating these bonds onto the blockchain, making these products accessible and liquid.

Trade wars are reshaping the global economy. They impact entire industries and reconfigure strategic balances. Among the companies directly affected, Tesla finds itself on the front line facing the new tariff measures imposed by Donald Trump. Tesla, for which China is the second-largest market after the United States, could pay a heavy price for this economic escalation.

For decades, the US dollar has dominated international trade and has established itself as an essential global reserve. However, this absolute reign is now challenged by the BRICS bloc. As a result, geopolitical tensions and the rise of cryptocurrencies are pushing several countries to seek alternatives to the greenback. Bitcoin and stablecoins are emerging as instruments capable of circumventing the supremacy of the dollar, but paradoxically, they could also reinforce its influence.

The crypto market is buzzing, traders are accumulating, stablecoins are soaring. A prelude to a bullish party or the swan song before an unexpected crash? The riddle persists.

Since the announcement of the release of Pavel Durov, founder of Telegram, Toncoin (TON) has experienced a spectacular rise of over 50%. The crypto market, responsive to good judicial news, reacted immediately to the delight ofTON enthusiasts. This remarkable rebound highlights the influence of iconic figures and their impact on the cryptocurrency market.

As gold shatters its historical records by nearing $3,000 an ounce, Bitcoin wavers. The Bitcoin/gold ratio, a symbolic pillar for twelve years, has just broken its upward trend. An alarming signal for crypto enthusiasts? Amid geopolitical tensions, aggressive trade policies, and contrasting ETF flows, the financial landscape is fracturing. Is the reign of "digital gold" threatened by the renewed shine of the precious metal?

Crypto ETFs are crashing down like an uncontrollable wave. Avalanche joins the dance, but history has taught us that markets sometimes have a short memory... and a brutal correction.

Bitcoin continues to challenge traditional financial markets and generates increasing interest among investors. For several years, it has been compared to gold, often presented as its digital equivalent. But this time, Tom Lee, influential analyst and co-founder of Fundstrat, goes further and claims that Bitcoin will become the best-performing asset.