The American exchange Kraken transformed its European presence in 2025. MiCA license obtained from the Central Bank of Ireland, deployment in the 30 EEA countries, launch of the Krak Card with Mastercard, tokenized stocks xStocks, Circle partnership for stablecoins: a review of a year positioning Kraken as a major player in the European market.

News

Since the beginning of this year, a key indicator of the Bitcoin derivatives markets has experienced a sharp decline. The open interest (OI) has dropped by approximately 30% from its October 2025 peak. This decrease is accompanied by a massive reduction in leverage across the derivatives ecosystem. For many analysts, this movement could signal not only the end of an intense speculative phase but also the building of a solid foundation for a possible bullish recovery.

An explosive case shakes the crypto market: three Polymarket whales targeted for suspicious bets on Venezuela. Details here!

Gold and silver closed 2025 at record highs, and that rally has accelerated into early 2026. A combination of strong demand, constrained supply, and rising political uncertainty is driving investors toward precious metals. New concerns about central bank independence have further intensified buying pressure.

Las Vegas, NV, [15 January 2026] – High Roller Technologies, Inc. (“High Roller”) (NYSE: ROLR), a publicly listed global operator of premium online casino brands, today announced a strategic collaboration with Power Protocol to explore next-generation Web3-enabled engagement models. The initiative will…

Yield stablecoins are shaking up the crypto universe and worrying JPMorgan. The GENIUS Act could become the key to strict regulation. Between innovation and the threat of a parallel bank, the future of stablecoins is being decided now. Dive into the analysis of the issues and discover why this debate is crucial.

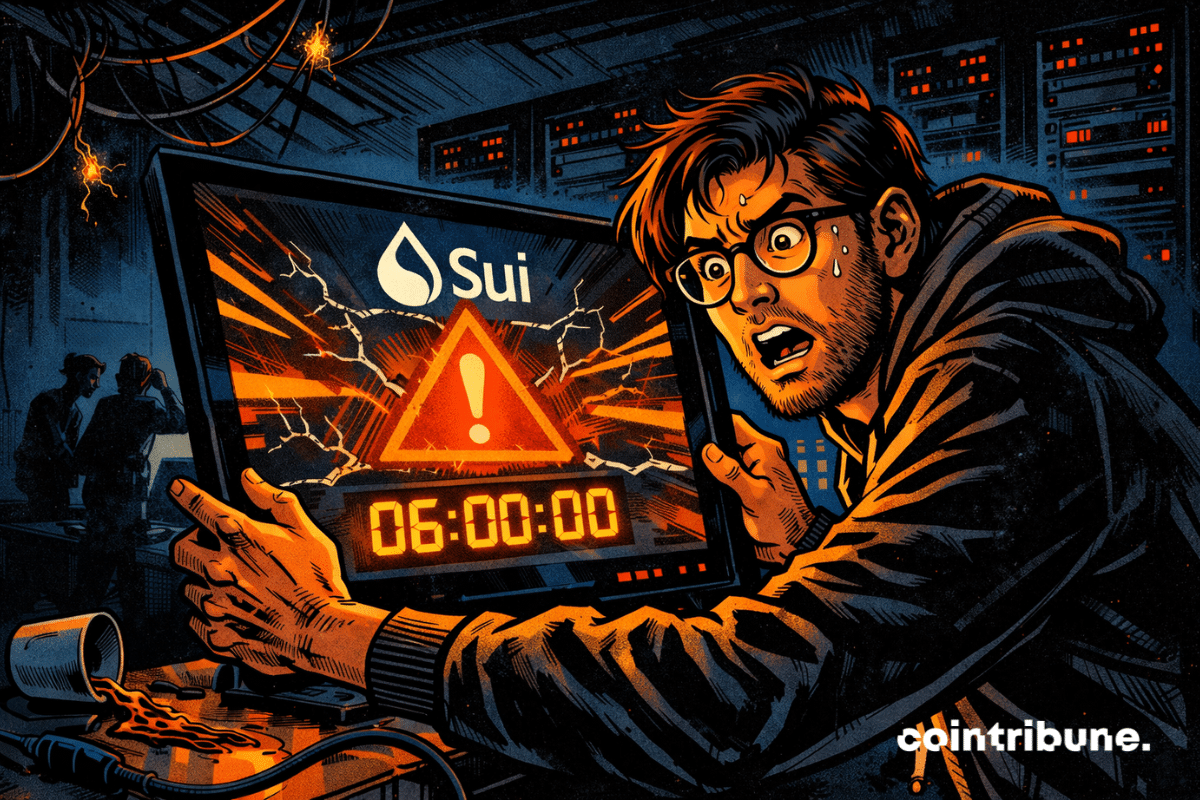

The Sui blockchain experienced a major outage lasting nearly six hours, completely interrupting transactions and freezing over one billion dollars of on-chain value. The incident, confirmed by the Sui Foundation, reignites the debate about the resilience of so-called “high-throughput” blockchains in a crypto context where technical reliability is becoming a…

The SEC has closed its investigation into the Zcash Foundation without filing charges. Indeed, the investigation, opened in 2023, focused on certain crypto offerings. This decision temporarily eases the regulatory pressure on Zcash, a project often criticized for its use of privacy-preserving transaction technologies. In a context where privacy coins are regularly targeted by authorities, the dropping of the investigation marks a notable turning point.

Bitcoin and Ether crossed major technical thresholds on January 14, triggering nearly 700 million dollars in liquidations on short positions. In the absence of a fundamental catalyst, this brutal movement highlights the weight of market mechanics and leverage effects in the dynamics of cryptos. Thus, in a few hours, the excess exposures were swept away, recalling the vulnerability of poorly calibrated speculative strategies.

Despite the frenzy around Bitcoin, some signals cool the optimism of crypto traders. Discover the details in this article.

In Washington, senators want to "clarify" crypto, but Coinbase slams the door. Clarity or control? The CLARITY Act turns regulation into a political battleground.

At the start of 2026, markets show a striking contrast: traditional funds attract record inflows, while Bitcoin ETFs lose momentum. This divergence, far from anecdotal, could signify a strategic shift among institutional investors, between seeking stability and persistent distrust of cryptos. In an uncertain economic context, arbitrages harden, redefining allocation priorities. Bitcoin, long touted as an alternative safe-haven asset, now seems relegated to the background by portfolio managers.

Two major cybersecurity incidents shook user confidence in late 2024: $7 million stolen via a compromised Chrome extension at Trust Wallet, and another personal data leak at Ledger. As attacks multiply, the industry is exploring radically different approaches to secure the ecosystem. In Brief Trust Wallet…

Bitcoin mining loves podiums. One number climbs, another falls, and the ecosystem tells itself a simple story. Except that in this industry, the way you count matters almost as much as the machines. And that’s exactly what makes the “Bitdeer moment” interesting. Bitdeer claims to have reached 71 EH/s of…

BitMine Immersion Technologies, chaired by Tom Lee, has just deposited an additional 186,560 ETH in staking. Its total climbs to 1,530,784 ETH, about 4% of all ETH currently staked on the Beacon Chain. This figure is significant. It comes at a time when the "validator entry queue" stretches to nearly 2.3 million ETH.

Franklin Templeton has upgraded two traditional funds to work on blockchain platforms, letting institutions manage stablecoin reserves with familiar tools.

France alerts: crypto companies ignore the MiCA regulation. Imminent shutdown? We tell you everything in this article.

U.S. Senate lawmakers are advancing efforts to establish a clear regulatory framework for crypto markets, marking a pivotal moment for digital asset oversight in the United States. Two Senate committees are preparing to debate competing versions of a long-anticipated market structure bill, setting the stage for negotiations that could determine how the industry is governed for years to come.

Polygon is already well known for its scalability solutions on Ethereum. The crypto platform now aims to become a regulated payment platform in the United States. This strategic shift is confirmed by major acquisitions that allow it to offer services compliant with US financial regulations.

Investment firm VanEck expects the first quarter of 2026 to favor risk assets, citing clearer fiscal policy, steadier monetary signals, and renewed interest across several major investment themes. After years of uncertainty, improved visibility is shaping how investors position their portfolios heading into the new year.

The crypto market is entering a major zone of uncertainty. According to Wintermute, the historic four-year cycle, a pillar of investment strategies for over a decade, may have reached its limits. In a report published in early January, the market maker mentions a deep break in 2025, a strong signal that 2026 will not be a simple rebound, but a true test of resilience for an ecosystem undergoing redefinition.

Is XRP preparing for a spectacular comeback? Patient crypto investors may soon reap the rewards of their wait.

While the regulatory climate in the United States remains uncertain, bitcoin surprises by surpassing $95,700. This weekly high comes despite the postponement of the CLARITY Act review, a key text for crypto regulation. Where markets once reacted with panic, resilience now dominates. Should this be seen as a sign of market maturity or a deceptive lull?

When a former politician buys a medical company to stack Bitcoins, crypto becomes a politico-financial novel where health and speculation share the same digital core.

The release of the latest Consumer Price Index (CPI) in the United States triggered a brutal movement on crypto derivatives, exposing an unprecedented imbalance on XRP. Ripple's asset recorded a wave of massive liquidations, revealing a lightning-fast repositioning of traders facing a possible monetary shift.

Vitalik Buterin, co-founder of Ethereum, sounds the alarm: current stablecoins threaten the stability of the crypto ecosystem. Discover the 3 critical flaws he has identified and why they could trigger a systemic crisis. Do solutions exist? The future of DeFi is at stake.

Binance promised light speed, Fermi delivers it: the blockchain is moving full speed... but will it hold up when crypto heats up and traders sweat?

There is talk of a 'treasure' of 600,000 BTC attributed to Venezuela: a figure that sounds like a threat. Washington is considering the idea of a seizure, without openly admitting it. Paul S. Atkins, chairman of the SEC, confirms nothing... but does not close the door. And that is where everything changes: bitcoin is no longer just an asset, it is a geopolitical lever. The essential remains to be decided: evidence, keys, and the power to seize.

Outset Data Pulse continues to map global shifts in the crypto mediascape. Following our in-depth reports on Asia, Latin America, and individual European subregions, we now turn our focus to Europe as a whole, examining how crypto-native and mainstream outlets performed across Eastern and Western Europe in Q3 2025 amid regulatory execution and changing discovery dynamics.

Ukraine has just blocked access to Polymarket, a crypto predictive markets platform. The authorities consider that the service resembles unlicensed online gambling. This decision does not only target a site. It mainly reminds that as soon as there is a stake and a possible gain on an uncertain event, the line with gambling becomes very thin. And crypto does not offer automatic immunity.