ChatGPT-4.5, OpenAI's latest innovation, has reached a significant milestone by passing the Turing test with an impressive success rate of 73%. This advancement demonstrates the ability of modern AIs to convincingly mimic human conversation, but also raises concerns regarding the risks of manipulation and fraud.

News

Stablecoins, these cryptocurrencies backed by real assets, could see their supply increase dramatically, reaching $2 trillion by 2028, according to a recent analysis. Currently valued at around $230 billion, this market could thus multiply by ten in the coming years, driven by imminent legislation in the United States.

How many bitcoins will the United States buy and how? White House advisor Bo Hines advocates using customs tax revenues.

Unanimity in the markets is never trivial, especially in the crypto world. On Binance, over 72% of traders are betting on the rise of XRP. Such a strong consensus, in the absence of a fundamental catalyst, is unusual. No Ripple announcement nor a technical breakthrough, just a collective frenzy. This increased confidence is thought-provoking. Is it a sign of a real recovery or an excess of optimism ready to burst? The market might have a completely different interpretation.

For the first time in its history, tech giant NVIDIA is launching the production of artificial intelligence supercomputers entirely in the United States. This strategic initiative aims to strengthen the American supply chain in the crucial AI sector.

According to a US government official, Bitcoin could become an alternative to gold for the coming decades. Details here!

Storms can erupt in the blink of an eye in the crypto sphere. Mantra (OM), once hailed by its supporters, has just experienced a dizzying 95% drop. As accusations of manipulation and opacity fly, John Mullin, CEO of the project, steps up. Between firm denial and promises of recovery, the scenario mixes a crisis of confidence with survival strategies.

Artificial intelligence feeds on data. But how far can it draw from our digital lives? The answer is taking a new turn in Europe. Meta has just obtained approval from European regulators to train its AI models on public content shared by its users. A decision that raises as many technological hopes as ethical questions.

The two crypto exchange giants, Binance and KuCoin, are facing significant service interruptions, disrupting the operations of millions of users worldwide.

Trump and Bukele, in their meeting at the White House, ditch Bitcoin to talk about prison and commerce. The future of crypto? It will have to wait until serious matters are settled.

Canada has just set a global precedent by approving the first spot ETFs backed by Solana (SOL), with staking options. While the United States struggles to move beyond Bitcoin and Ethereum, this Canadian initiative elevates Solana to the status of an institutionalized asset, marking a clear break in the hierarchy of listed cryptocurrencies. This is a strong signal for an ecosystem that has long been relegated to the background.

Bitcoin, often compared to a digital gold rush, is taking a decisive step. Imagine: 79 companies now hold nearly 700,000 BTC, equivalent to a treasure estimated at 57 billion dollars. These figures reflect not just an accumulation of assets, but a profound shift in investment strategies. Far from fleeting speculation, Bitcoin is establishing itself as a key piece in the reserves of economic giants. A silent but explosive revolution.

When Peter Brandt speaks, the markets listen. This trading veteran, active since the 1970s, dropped a bomb on the X platform: "Ethereum is a worthless trash." With over 700,000 followers and a reputation built on decades of technical analysis, Brandt is neither a troll nor an attention-seeking maximalist. His critique targets directly the second largest cryptocurrency in the market, which sparks a heated debate within the community and shakes the certainties of investors.

Starting from April 23, 2025, Google will implement new strict rules regarding crypto advertising in Europe, in accordance with the recently implemented MiCA (Markets in Crypto-Assets) regulatory framework. This decision, announced in a policy update on March 24, marks a major turning point for platforms wishing to promote cryptocurrency-related services on the search engine.

Bitcoin (BTC) recently made headlines by reaching $85,800 on April 14, 2025, before stabilizing at $84,600! Temporarily breaking a downward trend. This rebound comes after an unexpected announcement by U.S. President Donald Trump regarding a partial easing of import tariffs. But are Bitcoin bulls really back, or is this just a temporary surge? Let's analyze the key factors.

Billionaire Ray Dalio warns that the international order is about to change at the expense of U.S. monetary hegemony. Bitcoin is lurking.

Crypto ETFs are in free fall: $795 million withdrawn last week. Discover more details in this article!

Despite global economic turbulence and the volatility of the crypto market, the CEO of Strategy continues his massive acquisitions of bitcoin with a new purchase of 285 million dollars.

Charles Hoskinson made a post that says a lot. The man behind Cardano declares that his work is autonomous. No need for him anymore, it seems. However, he does not leave the stage quietly. He talks about a risky journey, a possible death. And above all, he insists: Cardano is decentralized. It's up to you to judge whether he is taking his bow or launching a new magic trick.

On April 13, Bitcoin surpassed $86,000 before plunging below $84,000, without any macroeconomic alerts or exogenous factors. This abrupt reversal can be explained by an unprecedented imbalance in liquidations: $52 million in long positions against only $15 million in short positions, representing a gap of 346%. This anomaly reveals a structural tension related to leverage, where excessive speculative optimism makes markets particularly sensitive to internal corrections.

China does not intend to yield to the new American protectionist measures. In response to the tariff surge imposed by Donald Trump, Beijing retaliates directly by demanding the immediate removal of tariffs, fearing the effects of a major global economic shock.

As the crypto markets catch their breath after a period of high volatility, all eyes are on three giants: Bitcoin, Ethereum, and Ripple. This week is set to be decisive, with critical technical levels and macroeconomic factors that could redefine market dynamics. Between hopes for breakthroughs and risks of correction, here’s what could shake up portfolios.

XRP finds itself at a strategic turning point, facing technical resistance that could redefine its market trajectory. Since the settlement of the dispute between Ripple and the SEC, the asset has gained renewed confidence, but investors remain cautious. The crossing of this decisive threshold is being closely watched: a failure could stifle the current momentum, while a breakthrough would pave the way for new highs. Thus, it is now a time for confirmation for supporters of the bullish scenario.

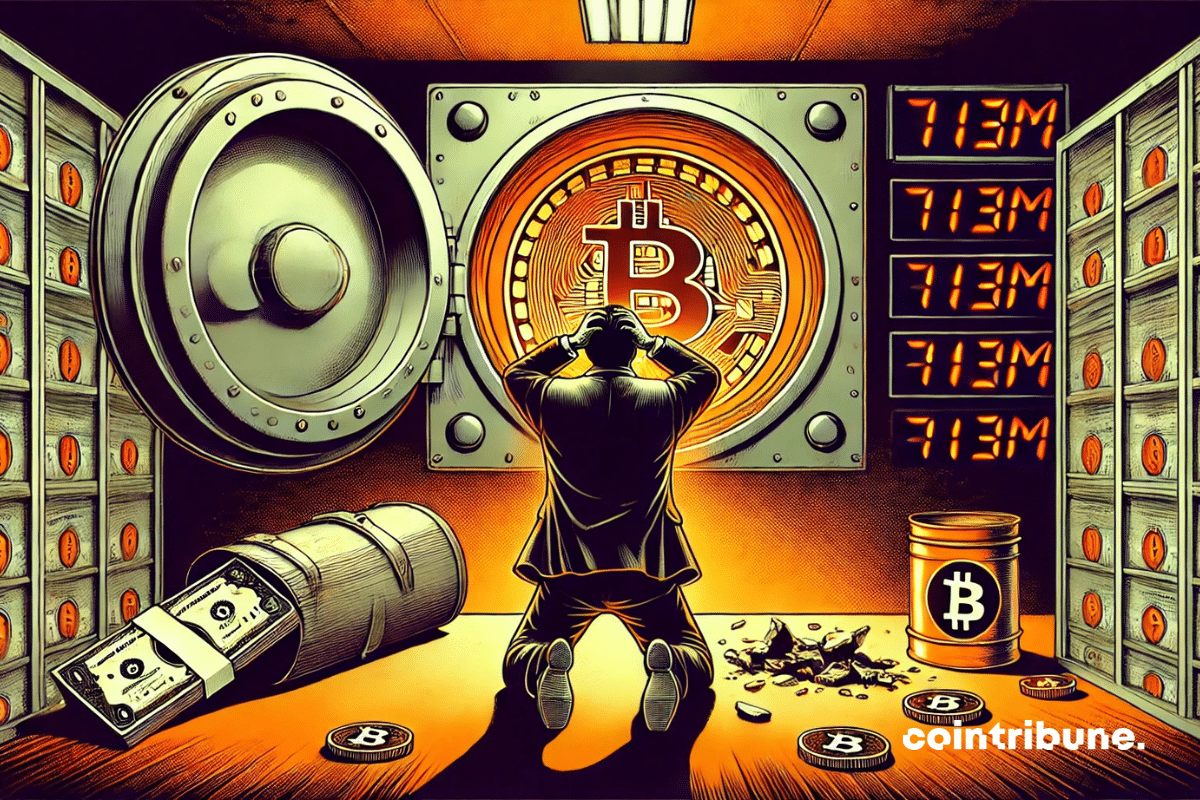

The increasing trade tensions between the United States and China have significantly impacted American spot Bitcoin ETFs. These financial products recorded a net outflow of $713 million last week, marking their seventh consecutive day of withdrawals.

As markets shake and capital flees risk assets, Michael Saylor stands firm. The founder of Strategy, indifferent to macroeconomic upheavals, has just added more than 22,000 bitcoins to his treasury. Indeed, the timing raises questions: BTC's correction is intensifying, and geopolitical uncertainty is settling in. However, Saylor does not waver. For him, bitcoin is not a gamble; it is a conviction. A sharp position, contrary to the consensus, which reignites the debate on the resilience of the maximalist strategy.

The recent imposition of massive tariffs by Donald Trump, followed by an unexpected pause on certain Chinese products, has thrown financial markets into turmoil. While some see this as a deliberate strategy to reorganize the global economic landscape, others interpret this turnaround as a capitulation to market pressures and Chinese intransigence.

April's volatility in the U.S. financial markets is worrying global investors. Since the surprise announcement of new tariffs by Donald Trump on April 2, the S&P 500 has lost 5.4%. However, it is mainly the signals from the bond market and the dollar that raise fears of a deeper movement: an exodus of assets out of the United States.

The MANTRA crypto project is facing an unprecedented storm. Its native token, OM, has lost more than 90% of its value in a few hours, erasing billions of dollars in market capitalization. A brutal drop that raises many questions within the crypto community and among investors.

A rare chart figure is forming on Ethereum, capturing the attention of crypto analysts. If confirmed, this setup could trigger a powerful upward movement, with a price target around $3,360 in the coming days.

XRP is making a strong comeback among the major contenders at the top of the crypto market. Standard Chartered expects a surge of 500% by 2028, enough to surpass Ethereum in market capitalization. Such a scenario would place Ripple at the heart of new digital balances, just behind Bitcoin. This rise is supported by the momentum of tokenization, the growing commitment of institutions, and an improving regulatory climate. The hierarchy of cryptocurrencies may be on the verge of tipping.