After The Halving, Another Drama Is Brewing For Bitcoin Miners.

Bitcoin miners can finally breathe: their revenues are stabilizing at $3.6 billion, despite the Bitcoin halving in April 2024. But behind this apparent calm, a storm is brewing. Rising costs, dependence on Bitmain, pressure on fees… Will the model hold up much longer, or is it headed for disaster?

Mining Bitcoin: resilient revenues, but at what cost?

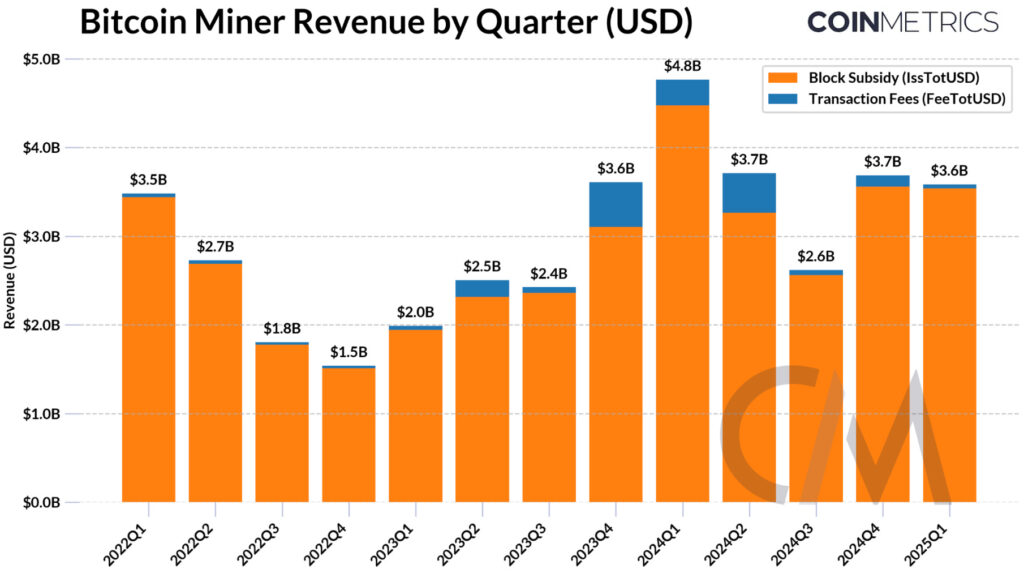

On one side, the numbers are reassuring. $3.7 billion in the fourth quarter of 2024, and still $3.6 billion in early 2025. Miners have absorbed the shock of the last Bitcoin halving of 2024 and maintained their profitability. But behind this solid facade, the pressure is very real. Fewer BTC generated per block, reduced margins, and a network that is increasingly power-hungry.

And to make matters worse, Bitmain holds between 59% and 76% of the global hashrate, an almost monopoly that raises concerns. Why? Because the supply of ASIC machines is ultra-concentrated and depends heavily on trade relations between China and the United States. Recent customs restrictions have already slowed down some deliveries. As a result: American Bitcoin miners must juggle with unpredictable delays and increasing uncertainty.

From mining to artificial intelligence (AI): a vital diversification

To stay afloat, miners are innovating. Some are migrating to regions where energy is cheap: Africa, Latin America, or even the wind farms in Texas. Others are taking a surprising turn: hosting data centers for AI. Core Scientific, for example, is already dedicating 200 MW to this activity. A clever bet, which allows them to monetize existing infrastructures while protecting themselves from Bitcoin fluctuations.

Today, only 1.33% of mining revenues come from transaction fees. A figure too low to offset the decline in block rewards. For the model to hold, there will need to be more on-chain activity. Will the Lightning Network and layer 2 solutions be the key? One thing is for sure: between store of value and medium of exchange, Bitcoin is evolving. And with it, the whole mining ecosystem.

Bitcoin miners have thus overcome the last halving, but the real test is just beginning. In April 2025, the network difficulty could jump by 16%, making the equation even more complicated: obsolete machines, plunging transaction fees, and a stagnant hashprice. The weakest may disappear. Who will survive the storm?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.