Record Influx of Crypto Funds: Back to the Top Since the 2021 Bull Run!

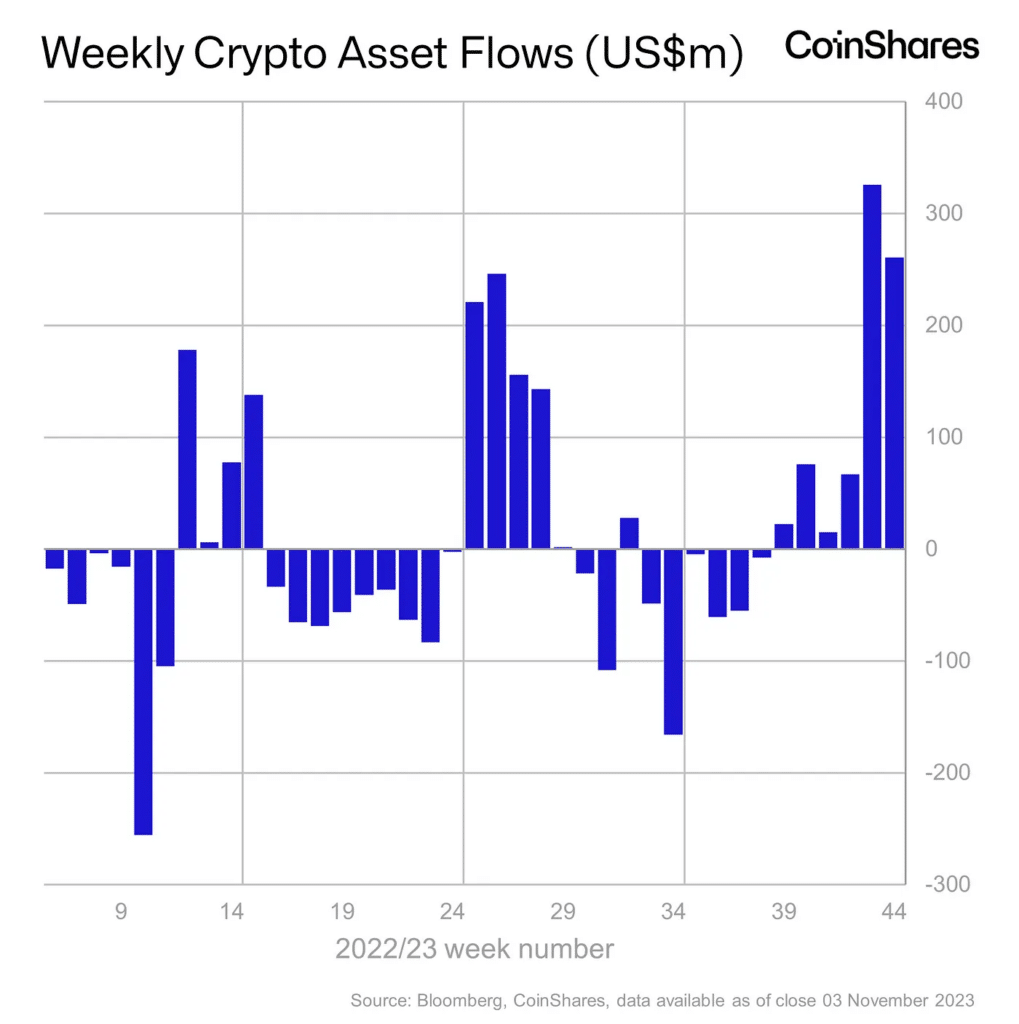

The crypto market is currently experiencing a remarkable surge in activity, with an influx of $767 million over the past six weeks. This historic trend echoes the frenzy of the bullish market in 2021.

Massive Inflows into Crypto Funds

Over the last six weeks, crypto investment funds have seen a remarkable series of inflows, accumulating a total of $767 million.

According to the CoinShares report, this wave of massive inflows is reminiscent of that seen in July 2023 but holds even greater significance as it marks the largest series of inflows since the end of the bullish market in December 2021.

“This run of inflows now matches the July 2023 run of inflows and is the largest since the end of the bull market in December 2021,” noted James Butterfill, head of research at CoinShares.

The majority of this influx has been directed towards Bitcoin (BTC) funds, attracting $229 million last week and totaling $842 million in inflows this year.

Several factors explain this surge, including the growing prospect of potential approval for a Bitcoin Spot ETF in the United States, as well as less favorable macroeconomic signals. These have encouraged investors to seek alternatives to safeguard their capital, contributing to the increasing popularity of Bitcoin.

The Resurgence of Altcoins!

However, Ether (ETH) funds have also seen a significant increase, with an impressive $17.5 million in inflows, the largest since August 2022.

This rise suggests a growing interest in the second-largest cryptocurrency, following a period of net outflows earlier in the year. Investors appear to be returning to Ethereum, possibly encouraged by technological developments and significant updates planned for the blockchain.

Additionally, Solana (SOL) funds received $11 million in inflows as the price of SOL hit a 14-month high. Chainlink (LINK) funds also attracted $2 million.

The massive $767 million influx testifies to a renewed interest among investors in crypto. Institutional investors seem to be showing a renewed appetite for digital assets after a bearish market period marked by FTX’s collapse. The year-end closure promises to be dynamic and full of twists and turns.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.