70 Crypto ETFs Await SEC Approval This Year

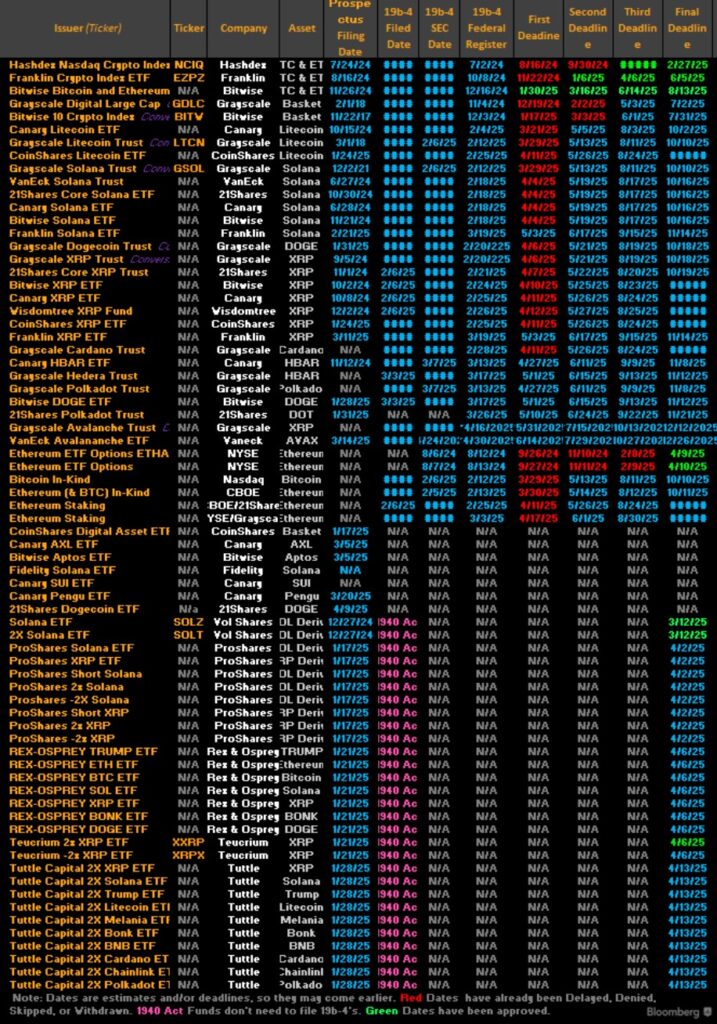

The year 2025 could mark a historic turning point for crypto ETFs in the United States. More than 70 funds are awaiting SEC approval, covering assets ranging from bitcoin to memecoins. A dynamic that could transform institutional access to crypto, but with no guarantee of success for all.

In Brief

- More than 70 crypto ETFs are awaiting SEC approval in 2025.

- 80% of institutions plan to increase their crypto exposure this year.

- ETF approval does not guarantee adoption, especially for lesser-known altcoins.

- 6 Solana ETFs await a coordinated SEC decision on April 29, 2025.

A wave of crypto ETFs on the horizon for 2025

2025 promises to be a decisive year for the U.S. crypto ETF market. According to Eric Balchunas, an analyst at Bloomberg, more than 70 exchange-traded funds are currently awaiting an SEC decision. These products cover a wide range of digital assets, from Ether to Solana, including XRP, Dogecoin, and even exotic memecoins like the “2x Melania”.

Everything, from XRP to Penguins to Doge, is going to be reviewed. It’s going to be a crazy year

Declared Balchunas on X, April 21.

Institutional adoption: caution despite enthusiasm

The bullish trend among institutions toward crypto continues unabated: more than 80% plan to increase their exposure by the end of 2025, according to a report by Coinbase and EY-Parthenon. However, analysts remain cautious: ETF approval does not guarantee the success of an asset. As Balchunas points out: “Having an ETF is a bit like being part of a band whose songs are available on all streaming platforms. It doesn’t guarantee you’ll be listened to, but it allows you to be where the majority of listeners are.“

While Bitcoin ETFs attracted over 100 billion dollars in 2024, altcoin-focused ETFs are expected to gather between 300 million and 1 billion dollars, according to Sygnum Bank. A difference that reflects investors’ caution toward more volatile cryptos.

Decisions expected between April 28 and May 3, 2025:

- Grayscale Solana Trust (GSOL)

- Final decision: 04/29/2025

- Final decision: 04/29/2025

- VanEck Solana Trust

- Final decision: 04/29/2025

- Final decision: 04/29/2025

- 21Shares Core Solana ETF

- Final decision: 04/29/2025

- Final decision: 04/29/2025

- Canary Solana ETF

- Final decision: 04/29/2025

- Final decision: 04/29/2025

- Bitwise Solana ETF

- Final decision: 04/29/2025

- Final decision: 04/29/2025

- Franklin Solana ETF

- Final decision: 04/29/2025

All these ETFs concern Solana (SOL) and are grouped on the same deadline! This suggests a coordinated wave of SEC decisions around this crypto by the end of April. Finally a Solana ETF?

With a wave of Solana ETFs in sight for the end of April, 2025 could well usher in a new era for altcoins in regulated markets. While SEC approval does not guarantee success, it nonetheless marks a key step toward broader institutional adoption of crypto assets.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.