5 Factors That Could Make or Break Bitcoin This Week

Bitcoin (BTC) continues to test traders’ patience as its price stagnates below the $100,000 mark. Between potential upward pressure and signs of weakness in the markets, here are the 5 key elements to watch this week.

5 signals to watch on Bitcoin this week: Danger?

This week is crucial for Bitcoin, with 5 major events that could completely redefine its trajectory.

1. A short squeeze and a rise in Bitcoin?

Since its historical record in mid-January, Bitcoin has oscillated in a price range between $90,000 and $105,000, failing to turn $100,000 into solid support. Some traders estimate that the next movement could be a short squeeze, forcing short positions to buy back and resulting in a sharp rise.

Analyst CrypNuevo highlights two key levels for Bitcoin: $93,300 in case of a correction and $99,200 in case of bullish liquidation. Trader CJ, on the other hand, targets $102,500 to $105,000 as a short-term ceiling, but warns that a return to around $80,000 remains possible before a bullish recovery.

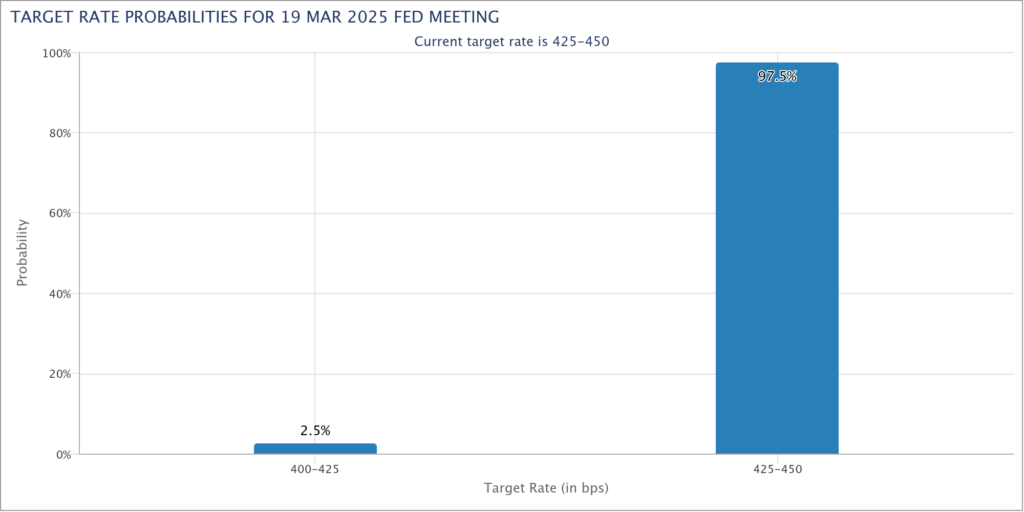

2. The FED and macroeconomic outlooks

This week is also marked by a busy economic agenda, including the release of the Federal Reserve’s (FED) minutes and new employment data in the United States.

Persistent inflation has cooled hopes for interest rate cuts in March. According to the latest data from the CME FedWatch Tool, the chances of a 0.25% cut are only 2.5%. A tighter monetary policy could therefore slow investors’ appetite for risky assets, including Bitcoin.

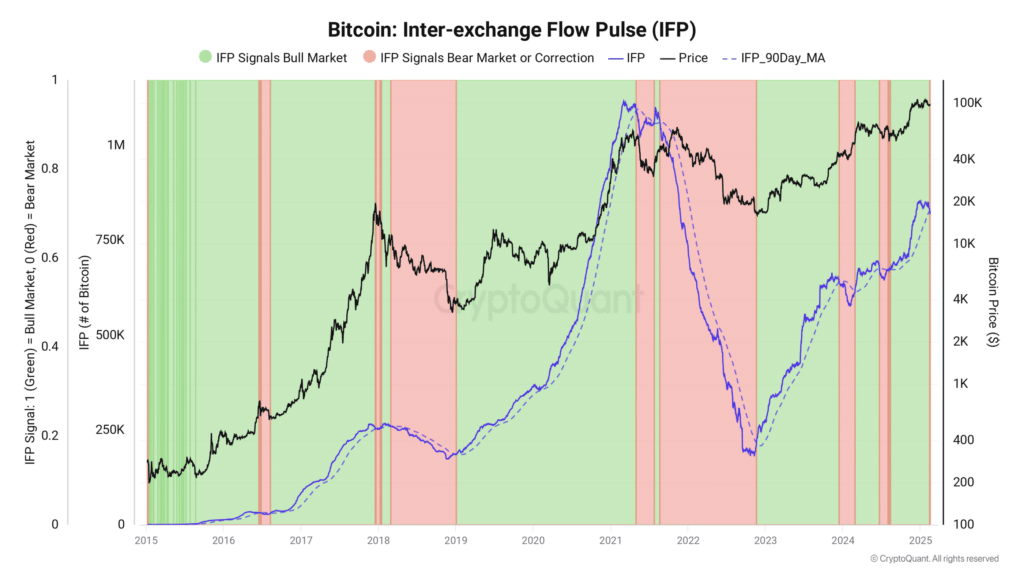

3. A bearish signal on exchange flows

Bitcoin flows between spot platforms and derivatives show a concerning change in trend. The Inter-Exchange Flow Pulse (IFP) indicator has entered bearish territory, signaling a reduction in investors’ risk exposure.

Historically, an increase in IFP precedes market peaks, which has not yet occurred this year. According to analyst J. A. Maartunn, this situation could mark the beginning of a bearish phase, although other indicators remain positive.

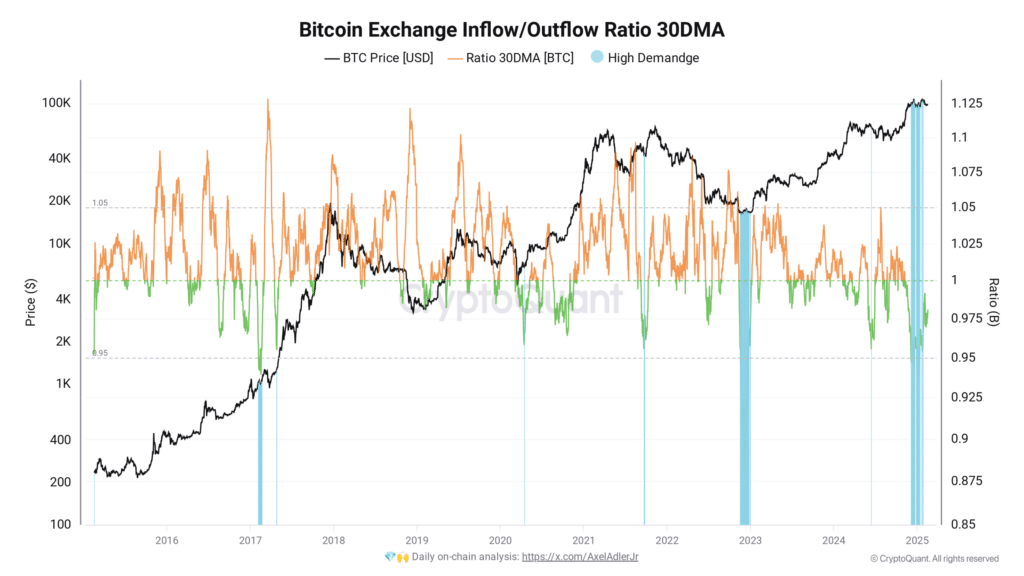

4. A consistently strong demand for Bitcoin

Despite the lack of a marked bullish trend, on-chain data indicates sustained demand. Analyst Darkfost emphasizes the ratio of incoming and outgoing flows from exchanges, with the 30-day moving average in a high accumulation zone.

This trend suggests that investors continue to accumulate Bitcoin, which could support a price recovery in the short term. However, some of these flows may be linked to asset transfers to exchange-traded funds (ETFs) and over-the-counter (OTC) desks.

5. A market flirting with “euphoria”?

The Net Unrealized Profit/Loss (NUPL) indicator for long-term holders shows that the market is entering a phase of high profit. A NUPL above 0.75 traditionally indicates euphoria that precedes market peaks.

During previous bullish cycles, this euphoria lasted from 450 days in 2013 to only 228 days in 2021. If the trend continues, it could indicate that the peak of the current bullish market is approaching.

A cautious and reactive approach

This week, Bitcoin traders and investors must adopt a cautious and reactive approach. In the face of an uncertain market, it is essential to monitor key levels, avoid overly aggressive positions, and adjust strategies according to exchange flows and macroeconomic decisions, particularly those from the Federal Reserve.

Bitcoin is therefore going through a phase of uncertainty, with a potential short squeeze that could push its price towards $102,000 – $105,000, but also bearish signals on exchange flows. The evolution of inflation and the FED’s monetary policy will play a key role this week, and in the weeks to come.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.