22,106 BTC Transferred To Binance Ahead Of CPI: Mere Coincidence?

Bitcoin is buzzing, Binance is filling its coffers, analysts are clashing… and the CPI is peeking around the corner. On the eve of a highly anticipated figure regarding U.S. inflation, the crypto market is boiling over like an overfilled pot. Amid Trump’s tariff tremors, reserves stacking up, and panicked tweets, the question becomes urgent: massive selling ahead, or a prelude to a rush for digital gold?

Binance cashes in BTC: towards a rush… or a wash?

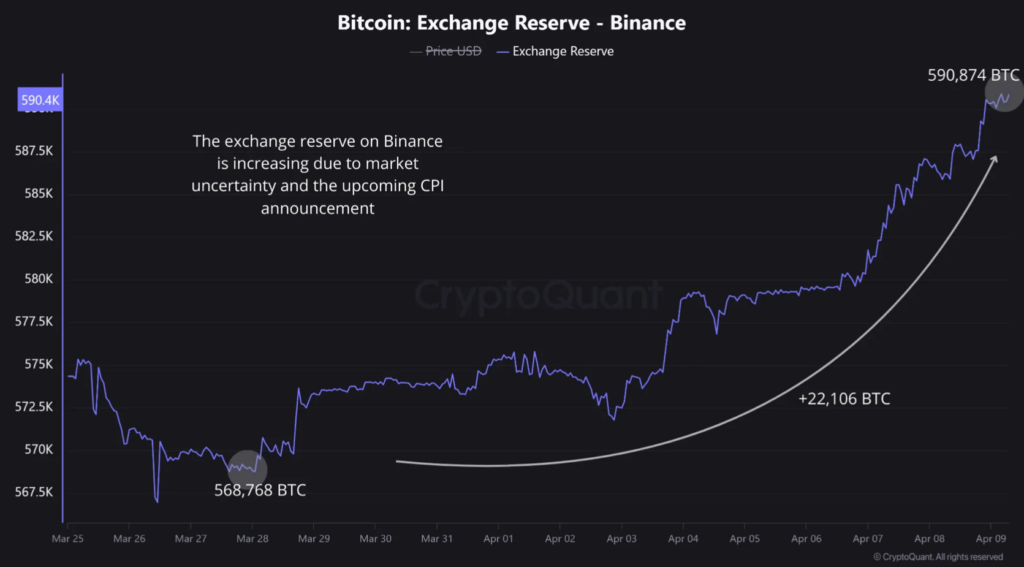

As Trump has suspended tariffs for 90 days, a warning came from CryptoQuant: in just 12 days, 22,106 BTC have been transferred to Binance, bringing the total to 590,874 BTC. A windfall of $1.82 billion more in the platform’s coffers, just before the announcement of the March CPI. Some see it as a simple game of musical chairs, while others interpret it as a clear sign of panic or speculation.

As contributor Maartunn summarizes:

This shows a strong acceleration of BTC inflows to Binance. It is likely that investors are actively moving their funds to Binance due to macroeconomic uncertainty.

And the timing is not insignificant: Trump has just suspended his tariffs on all countries for 90 days, except China, which faces a hefty 125% surcharge, in response to Beijing’s trade reprisals.

Immediate result: the price of bitcoin rises by 8.8% in 24 hours, flirting with $82,474 at the time of writing. But the real question remains: is this rise organic, or purely tactical?

CPI, inflation and tariffs: America breathes hot and cold

On April 10, the United States will publish the Consumer Price Index (CPI) figures for March. The consensus? A global inflation rate expected at 2.6%, down from 2.8% in February. A slowdown that could be good news for the bulls.

On X, Matthew Hyland doesn’t mince words:

Tomorrow’s CPI will likely show that inflation collapses to 2.5%.

But be careful not to bury inflation too quickly. If energy prices have indeed fallen, the tariff hikes announced by Trump could reignite inflation as early as April, especially in sectors sensitive to Chinese imports, like clothing or electronics. And economists at Wells Fargo warn: “The direction of history is clear.“

The core CPI (excluding energy and food) is expected to rise by +0.3%, with an annual inflation rate maintained at 3%. Enough to fuel the debates about the future of rates.

Pre-CPI Volatility: Traders Play Jumping Jack

In the meantime, traders are positioning themselves. Some are filling their portfolios. Others are filling Binance. Why? To sell if things go south. Or to buy faster than others if things explode.

But Pav Hundal, an analyst at Swyftx, prefers to nuance:

Large inflows can signal selling, but it’s a very fluid market. It’s plausible that Binance is funding its hot wallets in response to strong demand.

On the Federal Reserve side, ambiguity reigns. According to the CME FedWatch Tool, traders assess a 33% probability of a cut in May, but a 63% chance of 4 cuts by December. President Jerome Powell remains stoic:

We don’t need to rush. We have to see how everything evolves.

Meanwhile, the Fed is watching the divergence between goods and services inflation. If tariffs drive up imports, the situation could change faster than expected.

Bitcoin is walking a fine line. On one side, inflation seems tamed; on the other, Trump’s tariffs threaten to wake it up. Binance, on the other hand, is cashing in bitcoins like a Swiss bank vault on steroids. Between bullish anticipation and defensive caution, investors juggle. And the CPI? It will decide. Maybe. Or maybe not. In the meantime, the dice are cast — but the game is far from over.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.