150 More BTC! Metaplanet Continues To Stack Bitcoin Without Limits

Accumulate Bitcoin as a strategic reserve? The Japanese government sees no utility in it. But Metaplanet, a local company, sees in the flagship crypto a golden opportunity and dreams of dethroning MicroStrategy. With a massive acquisition strategy, it fuels investor interest and shakes markets. Its latest gamble? A new acquisition of BTC that brings it even closer to its titanic goal.

Metaplanet snatches 150 BTC at a bargain price: a hectic race towards 21,000

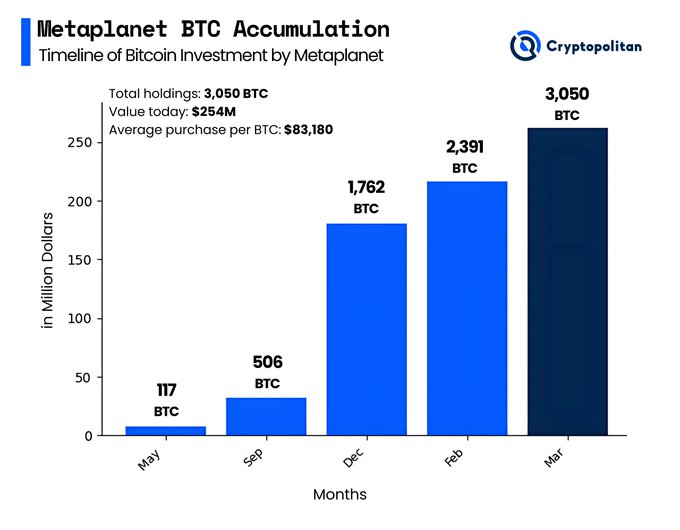

On March 18, Metaplanet added 150 BTC to its digital treasure for the tidy sum of 1.88 billion yen (12.6 million dollars). Not enough to impress the giants of the sector, but this acquisition fits into a well-oiled strategy: reaching 10,000 BTC by 2025 and 21,000 BTC by 2026.

Inspired by MicroStrategy, now rebranded as Strategy, Metaplanet positions itself as one of the largest holders of bitcoin in Asia.

To feed its bitcoin appetite, the Japanese company issues stocks rather than dipping into its reserves. The result? A spectacular growth of 4,800% in its market capitalization since it bet on BTC. However, not everything is rosy: after its latest acquisition, the company’s stock fell by 0.5%.

Will its bet hold in the long run, or will it eventually burn its wings?

Metaplanet’s attraction to bitcoin intrigues analysts, especially since the company seems to align itself with a long-term vision.

At the beginning of March, its purchase of 497 BTC had already propelled its stock by 19%. But can it really compete with Strategy and its 499,096 BTC?

A bitcoin treasure built on debt: brilliant bet or ticking time bomb?

Buying bitcoin on credit, a crazy idea? Not for Metaplanet, which takes advantage of historically low interest rates in Japan to accumulate BTC without overly diluting its shareholders. This approach allows it to invest massively and fuel its ambition to become a major market player.

Some figures illustrating this shopping frenzy:

- 3,200 BTC already acquired, worth 261.8 million dollars;

- Goal: 21,000 BTC by 2026;

- A market capitalization that has surged by 9,652% in one year.

However, its BTC yield has dropped from 310% to 60.8% this quarter. A decline that might worry some investors.

And what will happen if the market suddenly turns? Could this borrowing frenzy to buy Bitcoin become an insurmountable burden?

Michael Saylor, the pope of Bitcoin, seems convinced:

“Bitcoin is a hope for Japan.”

What if Metaplanet announced a new era where Japanese companies would massively adopt Bitcoin as a strategic reserve? Will Japan follow this trend or leave Metaplanet to venture alone in this field?

Could Japan establish a national reserve in bitcoin? Some analysts suggest so, especially in light of the country’s economic challenges. But if the Archipelago falters, the whole world will feel the tremors. Will bitcoin be the lifeline for a Japan in peril?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.