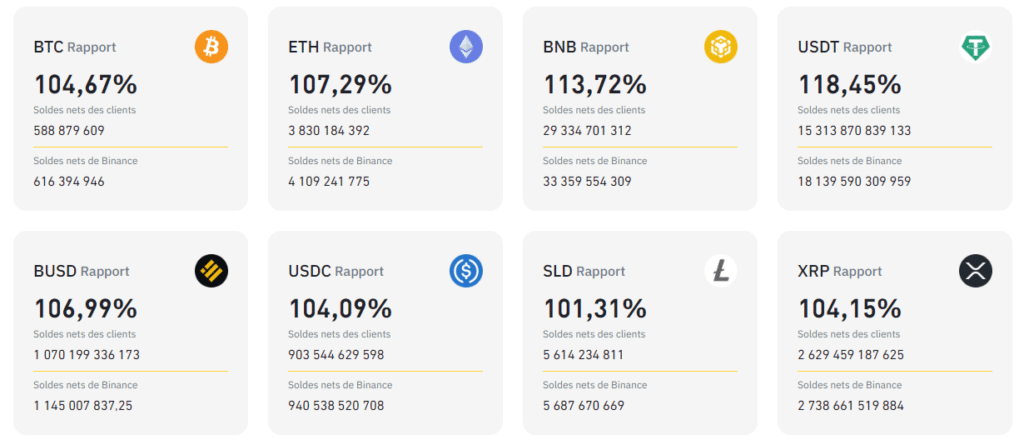

Binance releases its eleventh proof of reserve (snapshot date 10-1). Users' BTC assets were 588k, an increase of 0.12% from a month ago; users' ETH assets were 3.83 million, a decrease of 1.6%; users' USDT assets were 15.31 billion, a decrease of 0.8%.https://t.co/jGCPnwd2PR

— Wu Blockchain (@WuBlockchain) October 5, 2023

A

A

11th Binance Reserve Proof: Bitcoin Traders Back on the Scene?

Fri 06 Oct 2023 ▪

4

min read ▪ by

Getting informed

▪

Centralized Exchange (CEX)

Following the FTX incident, Binance opted for transparency to maintain the trust of its hundreds of millions of users. Thus, in November 2022, the crypto giant engaged Mazars, an international auditing firm, to facilitate access to reliable data concerning customers’ holdings in BTC, ETH, USDT, and more. In early October, Binance released its 11th Proof-of-Reserves (PoR) report. Details follow.

Binance Releases its 11th Cryptocurrency Proof of Reserves Report

The first report of this kind, published by Binance last November, failed to convince analysts. First, it lacked significant information regarding the structure of the crypto company. Additionally, our colleague pointed out, in an article, that the 1:1 ratio of reserves to Binance customer assets had not been achieved.

However, these remarks did not deter Binance from repeating the same action: publishing a proof of reserves report at the beginning of each month.

A brief comparison with the last report published in September confirms this slight increase in bitcoin holdings as reported by WuBlockchain. If the number of BTC was 588,000 a month ago, an additional 878 coins have been added to Binance’s wallets.

Regarding the declines mentioned for other altcoins, AMB Crypto did not fail to mention the strong regulatory pressures faced by Binance at the moment. The crypto media even went as far as to discuss a rush of investors toward self-custody solutions. Furthermore, the figures presented represent only a very small proportion of Binance’s offerings.

Is BNB Heading for a Crash?

AMB Crypto also provided an analysis of BNB’s evolution with the publication of this Binance proof of reserves report. On one hand, there are signs of accumulation of Binance’s native crypto since August 22. This could potentially indicate a BNB upswing.

But at the same time, the possibility of a crash cannot be ruled out. Crypto analysts observed a similar trend between June 12 and August 11.

Moreover, the 5% drop in BNB from its weekly high does not bode well. The Relative Strength Index (RSI) and Money Flow Index (MFI) for the period between June and August demonstrate low confidence in BNB. The weighted sentiment measure of BNB has also not risen since late September.

It’s worth noting that Binance’s crypto fell by as much as 14% between June and August.

In other words, the sentiment among crypto traders does not seem conducive to the long-awaited bullish rally.

At the time of writing this article, BNB was trading at $212.24 USD.

As for the increase in Binance’s bitcoin holdings, could it signify the return of BTC traders? For now, it’s challenging to make a definitive statement on this until further analysis from K33 Research provides compelling insights on the matter. Their latest report did indeed speak of a bitcoin trader exodus that shook the entire crypto industry.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.