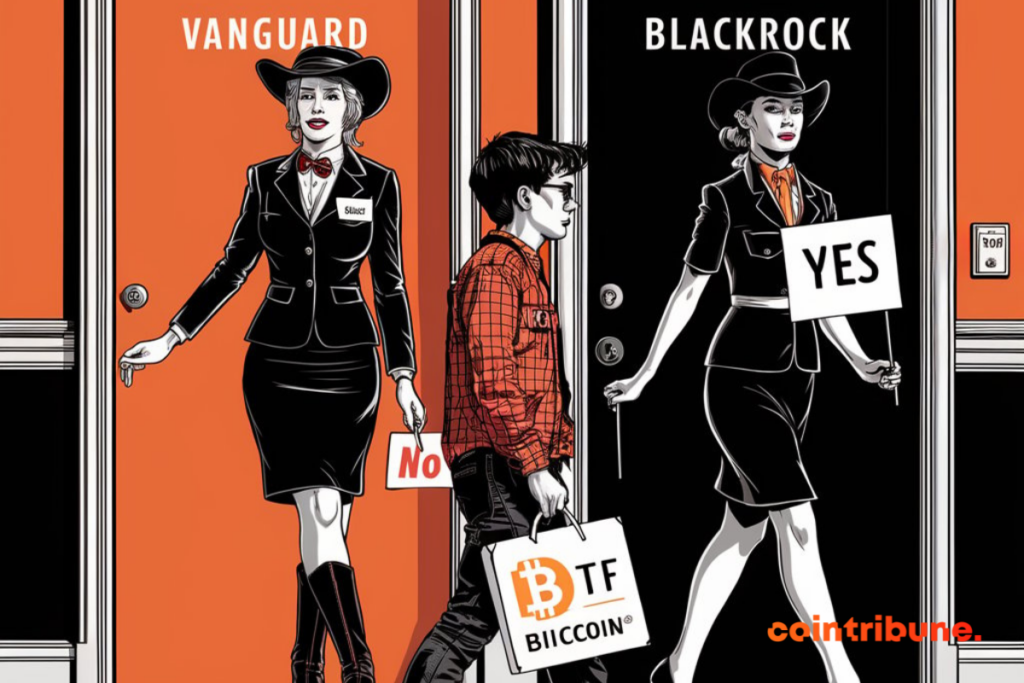

Crypto: Here’s Why Vanguard is Rejecting ETFs!

Vanguard, under the leadership of its CEO Salim Ramji, remains firmly opposed to the idea of launching a Bitcoin ETF. For Ramji, cryptocurrencies are “immature assets” and too volatile to fit into the company’s long-term investment strategy. Vanguard, despite the success of BlackRock’s Bitcoin ETF, does not wish to follow this path, prioritizing the long-term interests of its clients.

Vanguard and Cryptos: An Improbable Alliance

Vanguard has already said NO to Bitcoin ETFs last March and is not ready to revise its decision. For Salim Ramji, copying BlackRock would only betray the very essence of Vanguard, which aims to be a reliable actor for its investors in the long term.

Cryptocurrencies like Bitcoin, Ethereum, and Solana are deemed too risky and volatile to be integrated into a stable and sustainable investment strategy.

As Ramji says, in an interview with Allan Roth, “Vanguard must remain true to what it is.”

By refusing to include crypto products in its offer, Vanguard remains consistent with its history of avoiding speculative trends, even if it means forgoing potential short-term profit opportunities.

BlackRock, for example, has garnered over $1 billion in one month with its Bitcoin ETF. Vanguard, on the other hand, prefers to focus on investments deemed safer, even if it means missing out on the windfall of crypto assets.

Bitcoin: BlackRock’s Choice, Vanguard’s Rejection

While BlackRock, with its iShares Bitcoin Trust, rides the wave of Bitcoin ETFs and attracts billions, Vanguard persists in its rejection of cryptos.

Ramji does not want to sacrifice Vanguard’s reputation for stability for quick gains. Vanguard has a long tradition of prudence: it resisted the internet bubble of the 2000s and also stays away from other speculative investments.

Maximisez votre expérience Cointribune avec notre programme 'Read to Earn' ! Pour chaque article que vous lisez, gagnez des points et accédez à des récompenses exclusives. Inscrivez-vous dès maintenant et commencez à cumuler des avantages.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

Les propos et opinions exprimés dans cet article n'engagent que leur auteur, et ne doivent pas être considérés comme des conseils en investissement. Effectuez vos propres recherches avant toute décision d'investissement.