Consensys, Solana And Uniswap: $239 Million Offered To Trump's Investment Fund

In January 2025, the crypto industry made massive donations to Trump’s inauguration fund. One month later, the SEC miraculously dropped its lawsuits against those same donors. Coincidence or bought political influence? The line between financial support and regulatory favoritism has never seemed so blurred.

In brief

- Consensys, Solana and the CEO of Uniswap made significant contributions to Trump’s inauguration fund.

- The SEC dropped its lawsuits against these companies shortly after their contributions.

- In total, 239 million dollars were raised by the inauguration fund between November and April.

- Other giants like McDonald’s, Meta, and Apple also participated in the donations.

Massive donations from the crypto industry after Trump’s election

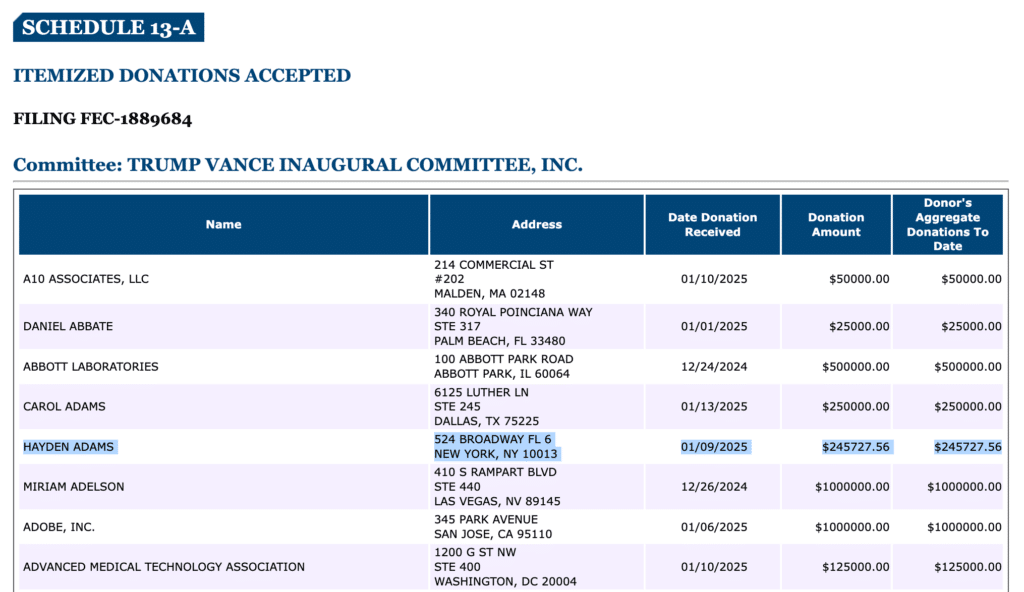

On April 20, 2025, the Federal Election Commission (FEC) made public documents revealing the extent of contributions to the Trump-Vance inauguration committee.

Hayden Adams, CEO of Uniswap, personally contributed $245,000 last January. Solana Labs contributed one million dollars, while software publisher Consensys donated $100,000.

These contributions add to those from other major players in the sector such as Coinbase, Ripple Labs, Kraken, and Robinhood, all of whom had already expressed their financial support for Trump.

The crypto industry thus appears to have massively mobilized to support the new American president, seen as more favorable to their sector.

The inauguration fund also received significant contributions from companies outside the crypto world, including McDonald’s, Meta, Apple, Delta Air Lines, and Nvidia, bringing the total net donations to $239 million between November and April.

A swift abandonment of lawsuits against donors

Since Trump’s inauguration on January 20 and the appointment of Mark Uyeda as head of the Securities and Exchange Commission (SEC), the agency has dropped numerous investigations targeting crypto companies, particularly those who contributed to the inauguration fund.

In February, just one month after the donations, Uniswap announced that the SEC had dropped its investigation. Similarly, Consensys benefited from the termination of a legal action initiated by the agency. Ripple, Kraken, Robinhood Crypto, and Coinbase, which collectively contributed $9 million to the inauguration fund, also saw their cases abandoned.

This situation raises questions about possible conflicts of interest, especially as the Trump family is involved in several crypto-related projects.

The president notably launched his own memecoin on the Solana blockchain on January 17, while his family created World Liberty Financial, a company issuing a stablecoin pegged to the US dollar.

These developments come at a critical moment when US lawmakers are considering new regulations to govern blockchain technologies, placing the Trump administration at the heart of significant financial and ethical issues.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.