Bitcoin: Year-end forecast

As we enter the final months of the year on the financial markets, there may be a seasonal trend known as the end-of-year rally. This trend intensifies before the Christmas holidays. Let’s take a look at bitcoin’s behavior in the run-up to Christmas, and the factors that can influence its price.

Parallels between the creation of bitcoin and the economy

Although there are many schools of thought on the subject, the economic context remains an important element when it comes to financial markets in general. But what about bitcoin? While this leads to much debate about its usefulness, I believe that the creator(s) of bitcoin had a deep understanding of economics.

Bitcoin was created was in 2009, shortly after the 2008 financial crisis. To save the economy from the brink of collapse, the US central bank (the FED) implemented a program of quantitative easing. This involves injecting liquidity into the financial system, more commonly known as money printing. The more liquidity is injected, the greater the supply of currency (in this case, the US dollar). In parallel, when bitcoin was created, a system was put in place to reduce the supply every 4 years (the halving process), as well as a global supply limited to 21 million bitcoins. This acted as a sort of counter-offensive against the FED and its liquidity injection program.

The current economic context

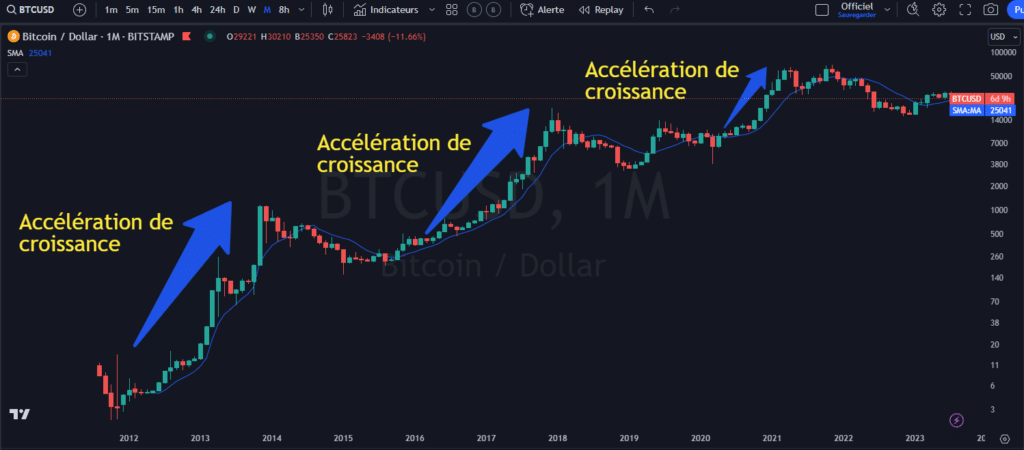

When studying the economic context, we take into account a number of factors, such as growth, liquidity and inflation. As far as growth is concerned, the focus is on its cyclicality, i.e. the acceleration and deceleration of growth. Accelerating growth remains a positive factor for all financial market assets. However, a slowdown in growth can generate more periods of volatility. Here’s an example of growth accelerations:

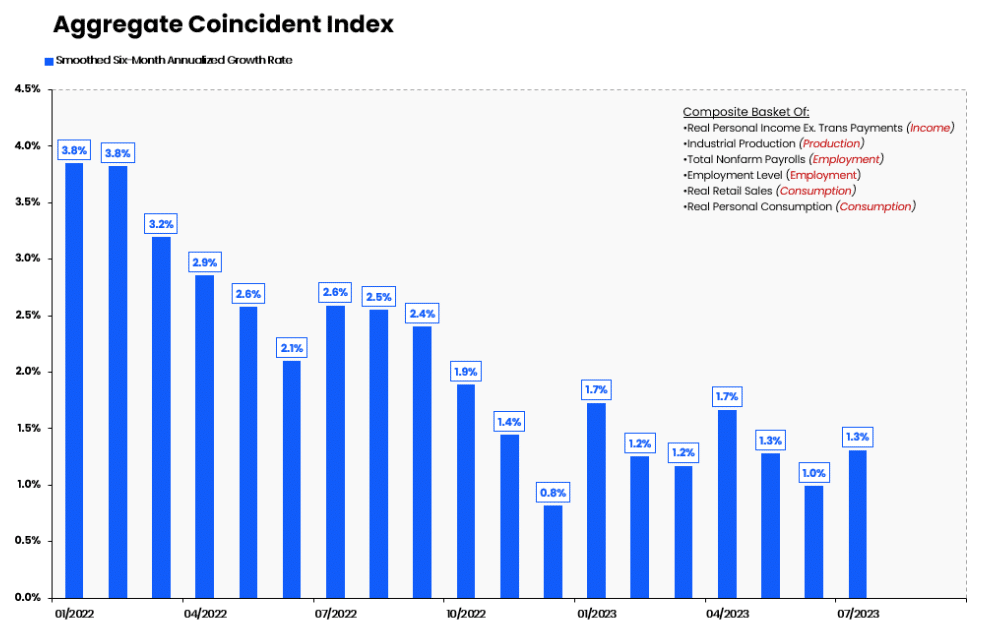

Currently, from an economic point of view, we are still in the process of slowing growth. Growth is running at around 1%, below the 2% average, but the job market remains resilient.

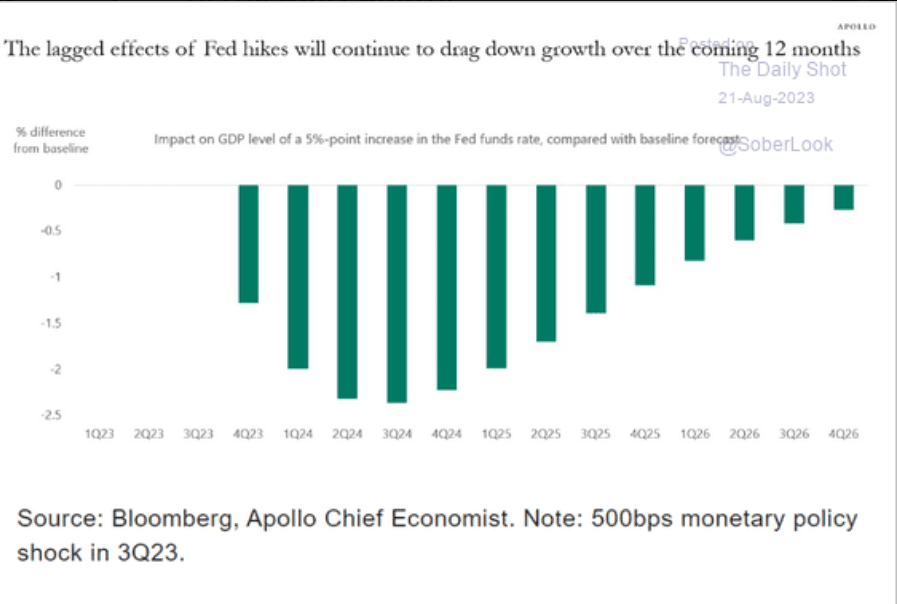

The fact that central banks are still applying a restrictive monetary policy means that economic growth is likely to continue to slow. The table below shows the lag effect between monetary policy and growth trends.

It can take more than 12 months for the consequences of a restrictive monetary policy to be felt. This is why one should always remain vigilant.

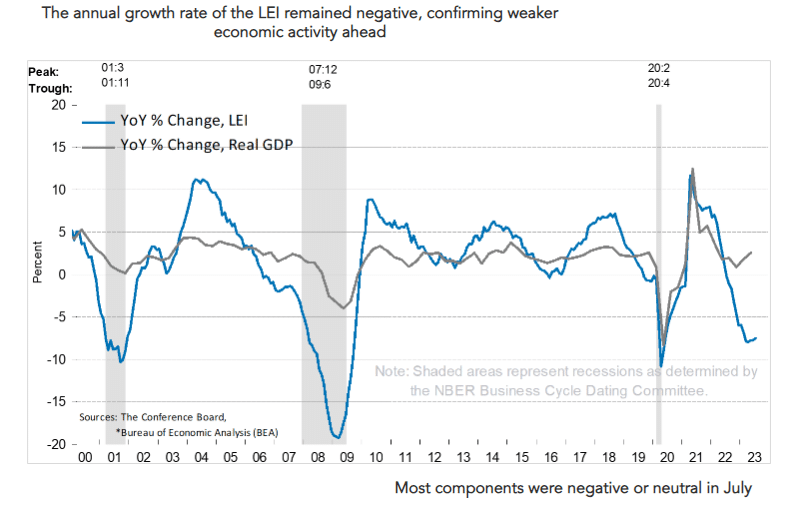

If we take into account the leading indicators that give us the direction of the economy, we can see that we are still in contraction, at around -8%. This also implies that we still have no prospect of an economic rebound for the time being.

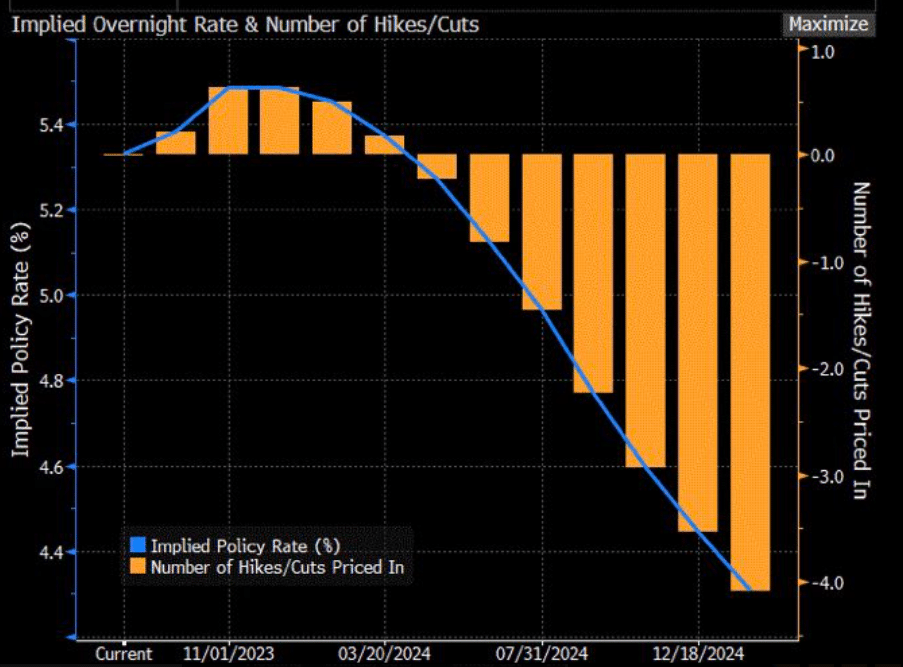

If we take a closer look at the probability of changes in key rates, we can clearly see that the forecasts point to a rate cut in March 2024.

That being said, a drop in rates is not always a good sign. Why not? Central banks cut rates because there is an underlying problem. It could be the start of a deflationary spiral, rising unemployment or a liquidity crisis. All these elements can have an impact on the evolution of stock markets as well as cryptocurrency.

Factors that can influence price trends

Before discussing the evolution and forecasts of the bitcoin price, let’s recall once again that it can depend on a number of factors. Some of these factors are listed below:

- supply and demand

- liquidity

- Halving

- The US dollar

- Economic context (growth, inflation, liquidity)

- External events

All these elements are also interrelated. For example, to stimulate growth, the central bank may need to inject liquidity. The process of injecting liquidity increases the money supply (in this case, the US dollar), and when the dollar goes into a steady downtrend, bitcoin rises if its demand remains strong. In parallel, when central banks become more accommodating (such as injecting liquidity and keeping rates low), this can increase demand.

On another note, the halving process, which assumes a decrease in supply every 4 years, may also be an average cycle calculated by its creator(s) to correspond to the average 5-year economic cycle. Perhaps there’s no such thing as chance.

Year-end bitcoin forecasts

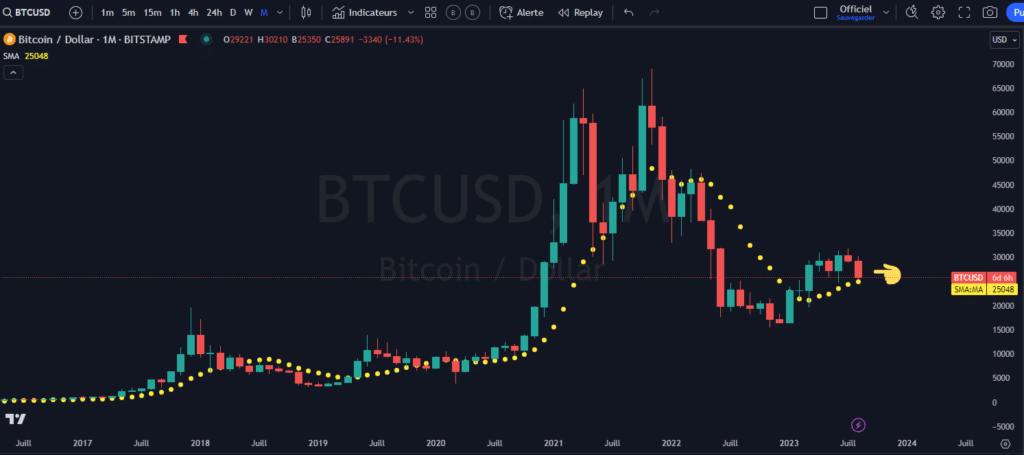

From a technical point of view, bitcoin is still above its 10-month moving average (monthly portrait), which remains technically bullish.

For the moment, bitcoin is acting like the end of an economic cycle. If we compare it to the end of the last economic cycle, between 2018 and 2020, we can observe similar behavior. There was a rebound after the bear market, but it didn’t push us towards ATHs.

Here are the different scenarios that I’m suggesting for the end of the year:

1/ Positive (albeit weak) growth, with inflation stabilizing at around 3% and the job market remaining resilient. In this scenario, bitcoin could continue to fluctuate in a price range between 20k and 30k.

2/ Continued positive (albeit weak) growth, with inflation falling below 3% and unemployment remaining low. In this scenario, we could break through the 30k barrier to reach 38k.

3/ Scenario number 3 remains the worst-case scenario. In other words, growth turns negative and unemployment rises. This scenario could see bitcoin retest its recent lows. This kind of scenario is likely to be a recessionary one, dragging down a good proportion of assets.

Bitcoin forecasts 2024-2025

On average, an economic downturn cycle lasts around 18 months. Sometimes it’s shorter, sometimes longer. Bitcoin bears occur when we have an economic slowdown. This is quite normal, as there is less liquidity in circulation. The last bitcoin top was made in November 2021, at the same time as the growth peak. So we’ve been experiencing a slowdown in economic growth for over 18 months. That said, there are several reasons why 2024-2025 could be better years for bitcoin to reach ATHs with a target of 90k-120k, we have:

- The 2024 halving;

- A possible change in the growth cycle during 2024;

- The bear market lasts an average of 18 months, and we’re already at 18 months.

Of course, this is based on probabilities only and is not guaranteed.

Past performance is no guarantee of future performance.

Conclusion

It’s important to remember that context is just as essential as price. Here, we have bitcoin behaving like the end of an economic cycle. In other words, a bear market followed by stabilization around a price range (20-30k). It is therefore possible that buying bitcoin today means buying bitcoin in its 2019 and 2020 price range. That said, before wrapping up, it’s important to remember that you should only invest money you’re comfortable losing.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Après avoir travaillé pendant 7 ans dans une banque canadienne dont 5 ans dans une équipe de gestion de portefeuille comme analyste, j’ai quitté mes fonctions afin de me consacrer pleinement aux marchés financiers. Mon but ici, est de démocratiser l'information des marchés financiers auprès de l'audience Cointribune sur différents aspects, notamment l’analyse macro, l’analyse technique, l’analyse intermarchés…

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.