Bitcoin ETFs See Largest Inflows Since January

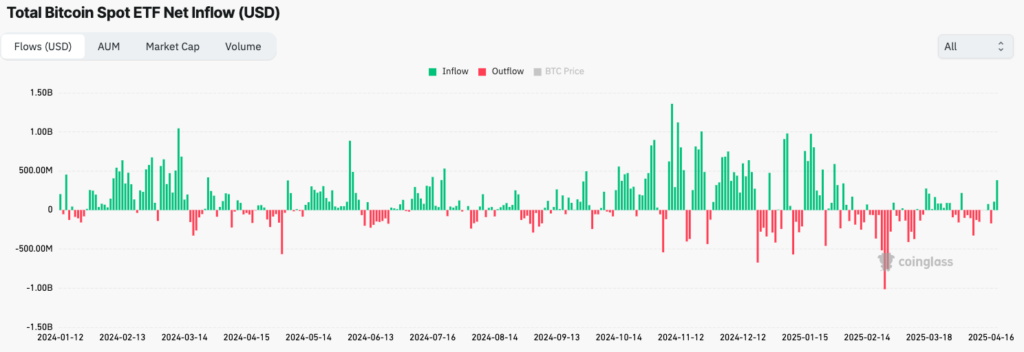

US-based Bitcoin ETFs recorded their largest daily inflows since January, as the crypto market regains strength after a difficult period.

In Brief

- US Bitcoin ETFs recorded $381.3 million inflows on April 21, 2025.

- The ARK 21Shares ETF (ARKB) led the charge with $116.1 million inflows.

- This recovery comes after bitcoin dropped below $75,000 in early April.

- Crypto markets held steady despite trade tensions affecting traditional markets.

A Strong Return of Institutional Investments

US Bitcoin ETFs posted yesterday, April 21, 2025, their best day in several months. These 11 investment funds attracted a total of $381.3 million, according to data from CoinGlass.

This performance represents the largest daily inflow since January 30. At that time, these funds had recorded $588.1 million inflows, just after bitcoin briefly surpassed the symbolic $100,000 mark.

Among the big winners of this exceptional day, the ARK 21Shares ETF (ARKB) stands out with $116.1 million in net inflows.

The Fidelity Wise Origin Bitcoin Fund (FBTC) comes in second with $87.6 million, followed by Grayscale funds which collectively gathered $69.1 million.

This renewed interest follows several difficult weeks for Bitcoin ETFs. Trade war threats from President Trump had previously caused capital flight. In early April, these funds lost $713 million in just seven days.

The Resilience of the Crypto Market Amid Economic Turbulence

Unlike traditional stock markets which closed in the red on April 21 with the S&P 500 down 2.4% and the Nasdaq falling 2.5%, the crypto market maintained its positive momentum throughout the Easter weekend.

The total market capitalization of cryptocurrencies increased by $800 billion during this three-day period, stabilizing at $2.84 trillion. Bitcoin largely contributed to this rise, surpassing a market value of $1.75 trillion for the first time since March 22.

The bitcoin price also showed a strong recovery, crossing $88,500, its highest level in four weeks. This impressive performance follows its 2025 low of $74,773 reached on April 7, a few days after Trump imposed new tariffs.

This swift rebound of Bitcoin ETFs demonstrates the growing resilience of the crypto ecosystem to global economic uncertainties. Despite external pressures, institutional investors seem to maintain their confidence in bitcoin as a strategic asset class to diversify their portfolios, notably in the face of Trump’s new tariffs.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.