A Debt Crisis of $175 Trillion is Inevitable

American entrepreneur and investor Balaji Srinivasan has just published an article in which he announces an astronomical debt crisis that would be inevitable. Ready for this $175 trillion financial tsunami?

A Prophesized Debt Crisis

Like Elon Musk, Ray Dalio or Jamie Dimon recognize, the Western world is heading towards a sovereign debt crisis.

Just as the establishment hid President Biden’s senility, they also hide the true state of the economy.

More Emergency Loans Than in 2008

First, did you know that the Fed made more emergency loans in 2023 than during the 2008 financial crisis?

The banking system is on life support thanks to the U.S. government, which first sold billions of bonds to financial institutions before devaluing them with surprise rate hikes.

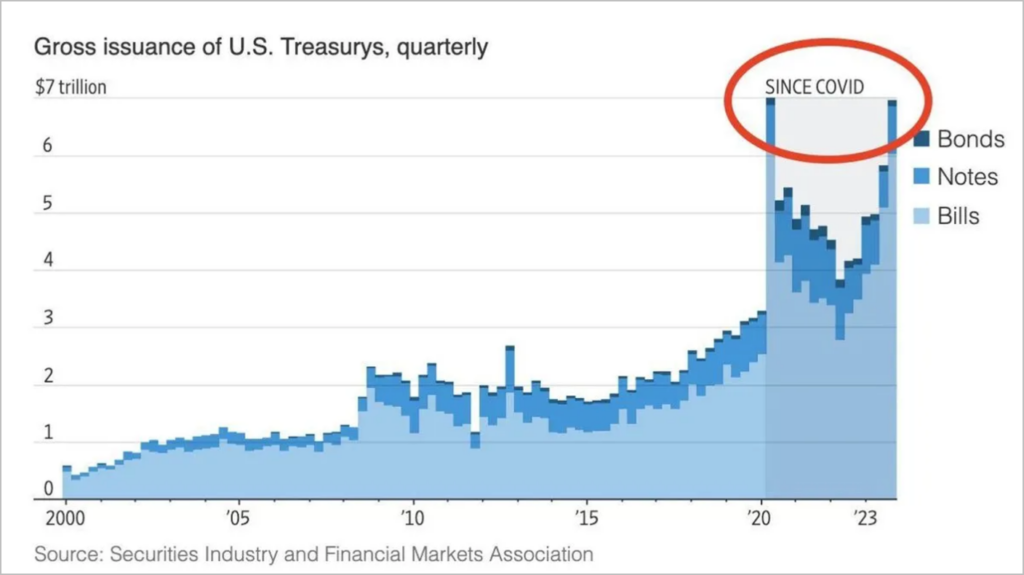

More Borrowing Than During COVID

Secondly, did you know that the U.S. is borrowing more under the “Biden boom” than during COVID?

At least, the COVID borrowings were at rates of around 0%.

But today, the U.S. government is borrowing historic sums in peacetime… and at rates of 5%!

It’s the act of a desperate man maxing out his credit cards to pay his bills!

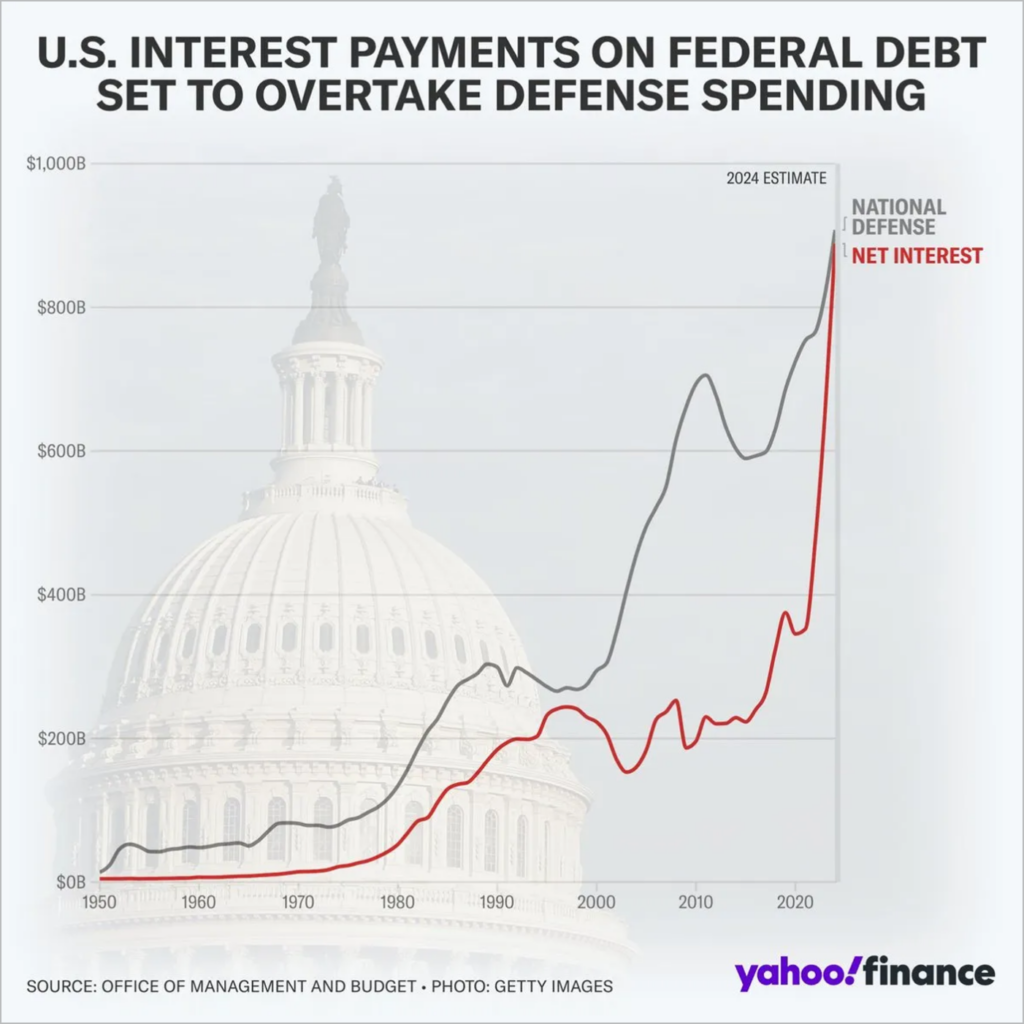

More Interest Payments Than Military Spending

Thirdly, did you know that all this borrowing has made interest payments on national debt the biggest government expense?

More than defense, or social security, or anything else.

Starting in 2024, payments to bondholders will be the first thing taxpayer money goes towards.

A New Dollar Devaluation

Did you know that the dollar has lost at least 25% of its value in just four years?

This, you probably know from living through the inflation.

But Larry Summers estimates that purchasing power has been eroded even more radically, with annual figures hitting 18% when including the huge spike in loan payments due to rate hikes.

Compound that over four years, and it would easily represent more than 25% of the dollar’s value.

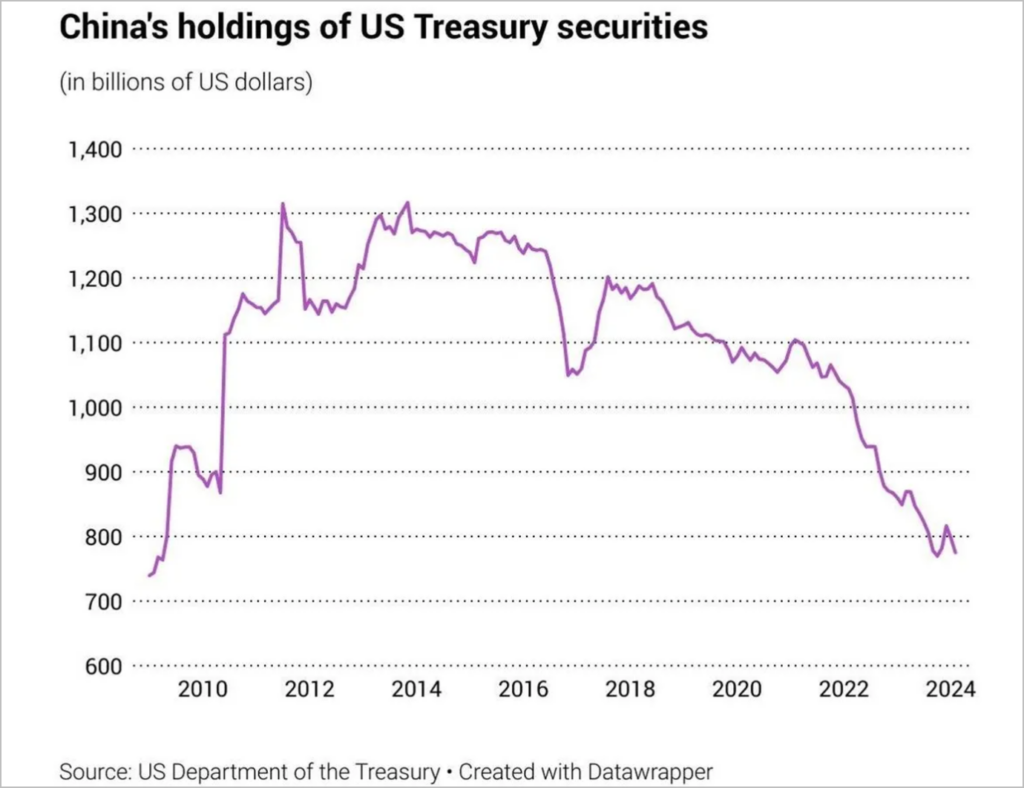

More Treasury Dumping by China

Next, did you know that China (the largest foreign buyer of U.S. Treasuries) has been unloading U.S. paper at an increasingly rapid pace?

It’s a bit technical, but China is an “outside investor” to the U.S., much like a new venture capital investor in your tech company is an outside investor.

Even by buying only 5% of your capital (or in this case, your debt), it sets the price for everyone else. And shows there’s strong outside demand from people who don’t need to buy.

More Gold Buying by BRICS

But isn’t the dollar a store of value?

What do other countries save in if not U.S. Treasuries?

Well, China is an indicator for much of the non-American world. And those countries have started hoarding historic amounts of gold even as Western countries sold gold.

A Stronger Dedollarization Than Ever

Recent data shows that the Chinese currency accounts for a larger share of cross-border payments: 52.9% in March-2024, compared to 42.8% for the U.S. dollar (and only 2.1% for the euro).

Less Effective Sanctions Than Ever

Okay, but can’t the dollar still be used as a sanction weapon?

Don’t countries need access to the U.S. financial system? Actually, no. All sanctions imposed on Russia ended up hurting Europe more than Russia.

Europe needed Russian oil and gas, but Russia had other customers.

According to the World Bank (not a Russian source!), Russia has just surpassed Japan to become the world’s fourth-largest economy in terms of GDP by PPP.

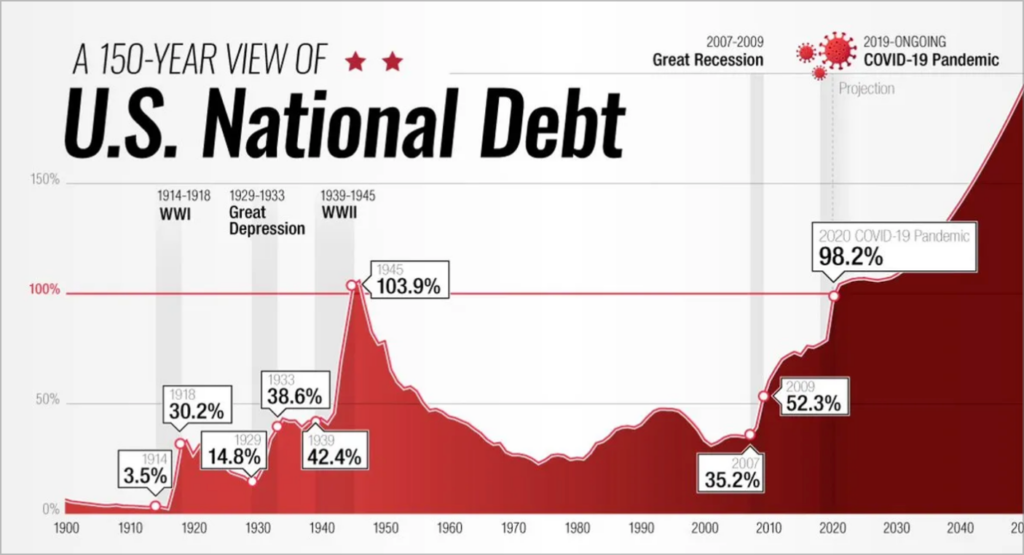

Peacetime Debt Close to World War II Levels

Okay, but what about the U.S. military?

Can’t it eventually go to war to protect the dollar? This is a much longer conversation, but see the graph below.

Today, the U.S. is in “peacetime”.

And yet they have debt comparable to World War II levels.

This means that the U.S. has neither the money nor the manufacturing base needed to sustain a military campaign against a rival like China.

You can’t fight your factory, especially when you have no money left.

A Real Debt Higher Than Any Empire in History

Finally, the most important figure might be 175.3T. This is actually the true U.S. debt, accounting for all entitlements like Social Security and Medicare.

And this figure is rapidly increasing.

This 175T debt is unpayable. And the U.S. government is far from having the means to pay what it owes.

It has made promises to everyone that it simply cannot keep.

To cling to power amidst this web of unkept obligations, it will become nasty at a level most people can’t really comprehend.

The U.S. Dollar Is Less Necessary, Just When the U.S. Needs to Borrow More

If you’re intellectually honest, you realize that the dollar’s position is rapidly eroding.

It is simply no longer the indispensable asset it once was.

China doesn’t need the dollar to trade as it uses the yuan instead. The BRICS don’t need the dollar to save as they buy gold instead of U.S. bonds. Russia doesn’t need the dollar to survive as it is the fourth-largest economy in the world after being excluded from the U.S. economy. Yet the U.S. needs as much of the world as possible to accept the dollar because it is borrowing at levels that exceed COVID, World War II, and any empire in history. A debt crisis is looming.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Chaque jour, j’essaie d’enrichir mes connaissances sur cette révolution qui permettra à l’humanité d’avancer dans sa conquête de liberté.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.