98% Of The Global Economy Is On The Assault Of CBDCs

True crypto aficionados have a soft spot for privacy and decentralization. Not really CBDCs, these central bank digital currencies that turn governments into modern Big Brother, watching every transaction from the shadows. If this idea raises the hackles of Bitcoin fans, a report reveals that 98% of the world’s economy is already exploring these new digital currencies.

CBDCs take control of global economies

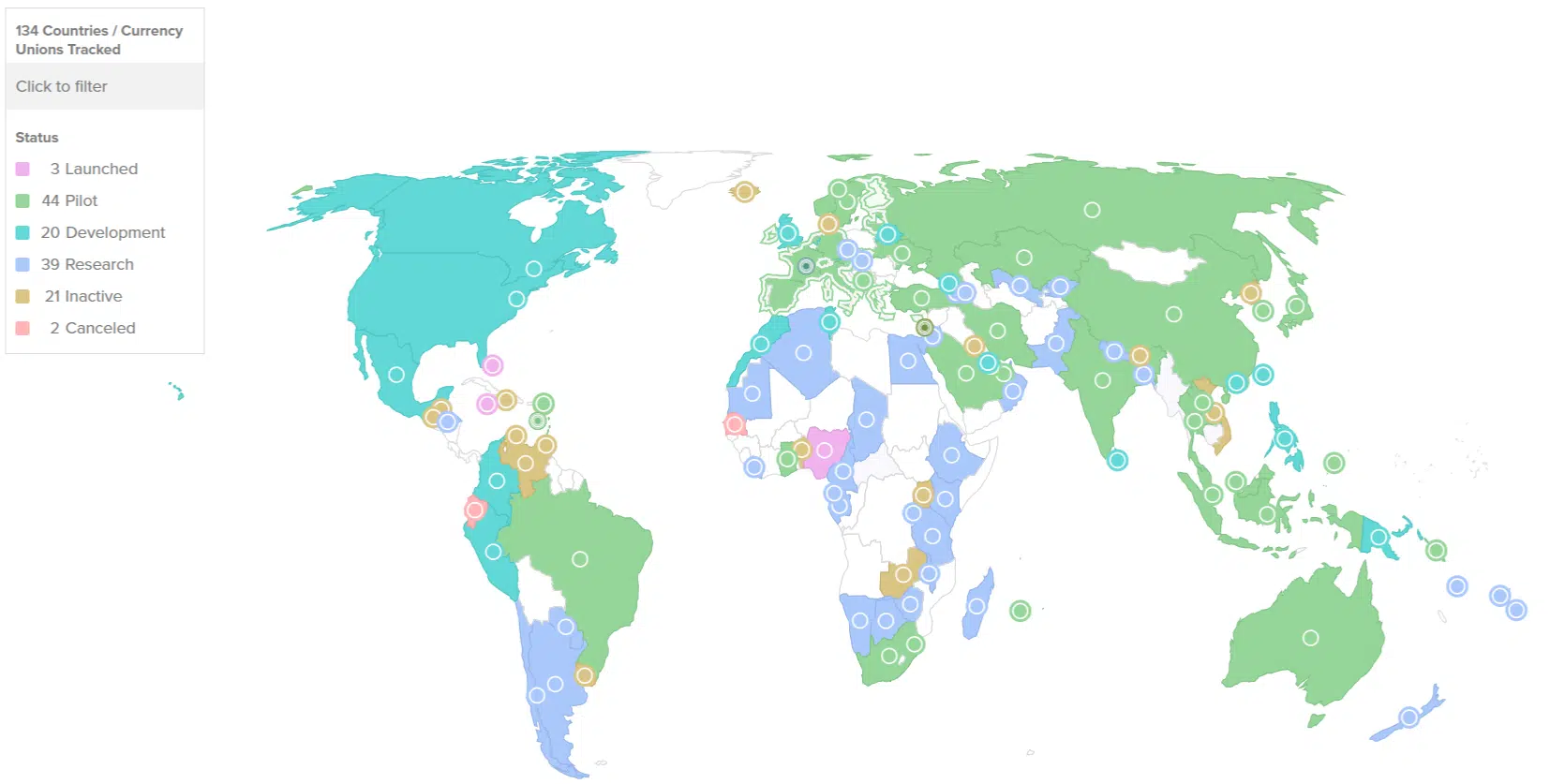

What was just an idea in 2020 has now taken on a global scale. Today, 134 countries representing 98% of global GDP are actively exploring central bank digital currencies (CBDCs), note the experts at Atlantic Council.

And the trend is not ready to reverse, as even major economies like India, Australia, and Brazil are testing this technology. In two years, the number of countries involved has increased from 35 to 134, an impressive leap that speaks volumes about governments’ ambitions.

Every G20 member, without exception, has put their foot in the CBDC stirrup. Of the 19 most advanced countries in this venture, 13 are already in the pilot phase, with major economies like Russia, China, and India at the forefront.

Even though only three countries (the Bahamas, Jamaica, and Nigeria) have already launched their CBDCs, all pursue national expansion goals.

- 134 countries exploring CBDCs;

- 65 countries in advanced stages;

- 3 countries have already launched their CBDC.

The Atlantic Council report highlights that interest in CBDCs intensified after Russia’s invasion of Ukraine – the latter wanting both Bitcoin and CBDCs, with cross-border projects now at the heart of geopolitical concerns. At this rate, CBDCs could become unavoidable, whether crypto purists like it or not.

The race for CBDC is not without obstacles for crypto

While CBDCs promise to make transactions more efficient, they raise significant questions, particularly for crypto advocates. Indeed, where Bitcoin (BTC) and its cousins advocate freedom and lack of centralized control, CBDCs risk imposing themselves as the ultimate weapon of financial totalitarianism. Some, more radical, even go so far as to say that “CBDC and widespread surveillance are one and the same“.

Governments supporting the transition to CBDCs advance several arguments: financial inclusion, reduction of transaction costs, and of course, transparency. But not everyone is convinced.

One of the most feared risks is a massive withdrawal of funds from traditional banks, which could destabilize already fragile financial systems. Not to mention the potential cyberattacks that always loom over such projects.

More concerning still, these digital currencies could redefine international power dynamics. China, with its digital yuan project which is shaping up to be a fiasco, has already taken a lead.

And if the BRICS, this increasingly influential emerging bloc, agree to launch their own alternative payment system, the dollar could well lose its role as the reference currency.

For the crypto community, CBDCs remain the bogeyman. The specter of centralized control and mass surveillance grates, reinforcing the idea that CBDC and totalitarianism are two sides of the same coin.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.